Part I explored: How do we build sustainable, decentralized network economics? Answer: Design systems that can support token utility.

Part II examines: What economic infrastructure drives that utility?

TL;DR: Global finance runs on siloed messaging networks that can’t verify each other, creating massive coordination costs across payments, securities, treasury, and compliance. ZKsync Interop replaces this fragmentation with a shared cryptographic fabric that lets institutions coordinate directly across chains, enabling potential ZK token utility through interop usage. Because this interop is built into the architecture institutions are already adopting, it naturally overcomes the chicken and egg problem of becoming a standard. This coordination layer enables potential ZK token utility through interop usage.

The Coordination Problem: Global Finance Runs on Incompatible Messaging Networks

In a largely electronic world, money moves through industries and geographies, but everywhere it moves, it moves based on messages and settlement layers.

A treasury instruction, a card authorization, a securities affirmation, an authentication response, a payment initiation, and a compliance check are all messages coordinating multi-party workflows across systems that share only the data and messages relevant to complete the transaction.

The problem: these messages are trapped in incompatible silos, and therefore the coordination requires expensive trusted intermediaries.

Your bank uses SWIFT. Your corporate treasury tool uses proprietary APIs. Your payment processor uses FedNow or SEPA. Your broker uses a different settlement system entirely. They all work within their own walls, but coordinating between them is expensive, slow, and error-prone.

Several background processes need to be completed before money can move from A to B and these processes are broken.

- In Payments: 6-8% exception rates, multi-hop dependencies, inconsistent messaging

- In Treasury: Finance teams stitch together dozens of bank APIs with fragile, custom integrations

- In Securities: Institutions manually confirm trades across multiple systems instead of using a shared ledger

- In Corporate Banking: Compliance checks happen privately in siloed systems, creating redundancy and friction

This isn’t a technical problem anymore, but a universal coordination one: institutions lack a shared, verifiable messaging foundation.

Current systems rely on trusted intermediaries that can fail, make errors, or be corrupted. ‘Trustless’ means institutions verify information through cryptographic proofs rather than trusting intermediaries. ‘Incorruptible’ means records cannot be secretly altered once created, eliminating entire categories of fraud and manipulation.

The Insight: Streamlining Financial Messaging Couldan Unlock SignificantEnormous Economic Value

Across all financial institutions globally, trillions of financial messages are exchanged each year, coordinating well over $4 quadrillion in annual economic value:

- ~2 trillion non-cash financial transactions annually (Capgemini).

- ~700 billion card transactions (Nilson).

- tens of billions of securities and FX post-trade messages (DTCC, CLS).

- Billions of treasury, trade finance, and corporate banking messages.

These figures describe the structural messaging layer that underpins global money movement, rather than revenue.

Today, institutions already operate these workflows at scale, but the lack of a shared, verifiable coordination layer forces them to reconcile data across many systems, driving operational cost, risk, and delays.

Across sectors, the surfaces most affected by this fragmentation include:

- Instant payment and A2A networks, processing well over 200 to 300 billion annual messages across RTP, FedNow, FPS, SEPA, UPI, and Pix. Even tiny mismatches in routing or confirmations create expensive exception handling cycles.

- Card authorization and clearing workflows, which include not just the approximately 700 billion transactions, but the multi stage messages underlying each (authorization, clearing, settlement, dispute). These chains are fragile because every hop is validated independently.

- Corporate treasury workflows, with mid-sized corporations generating tens of millions of annual approvals, confirmations, and reconciliations across multi bank setups. Today these steps are stitched together with PDFs, SWIFT MTs, and email confirmations.

- Identity and authentication, where large institutions routinely cross hundreds of billions of authentication and authorization checks across federated systems. Duplicate checks across systems add latency and create unnecessary security exposure.

- Securities workflows, where trade matching and post trade processing produce billions of messages with duplicated validation. Delays and mismatches directly translate into capital inefficiencies and settlement risk.

Looking at just these segments, we are in the hundreds of billions to low trillions of annual messages, and they are the areas where fragmentation is most visibly driving operational headaches today.

The Solution: ZK Interop as the Foundation for Direct Institutional Connectivity

This is where ZKsync’s native interoperability protocol changes the game.

Instead of a patchwork of emails, CSVs, proprietary APIs, and manual confirmations, institutions get a cryptographic messaging layer where all independent chains, public and private, can verify the shared state data directly through ZK cryptography without relying on trusted intermediaries.

The implications extend far beyond payments:

- In treasury, Interop can synchronize multi-bank instructions and acknowledgments.

- In card networks, Interop can express authorization and clearing messages as verifiable receipts.

- In securities, Interop can collapse costly, multi-step post-trade confirmations and settlement processes into verifiable, near-atomic events between chains.

- In cross-border transfers, Interior can coordinate ISO-20022 messages and eventually PvP settlement.

What unites these domains is not just how tokenized assets can move, but also how messages move.

As Jeremy Allaire (Circle’s CEO) notes, money velocity will expand in step with information velocity. Once message coordination between systems approaches near-zero latency, economic throughput scales non-linearly. Interop collapses that latency for institutions, turning today’s fragmented, slow message chains into instant, verifiable coordination.

Institutions keep their existing rails. They don’t rip out SWIFT or SEPA. They adopt Interop incrementally, as a coordination layer they can trust.

What changes is that previously siloed steps become explicit, standardized, verifiable events:

- A compliance check becomes a cryptographic receipt

- A KYC/AML approval becomes verifiable state

- A card authorization becomes a single, cryptographically verifiable event across all parties

- A treasury confirmation becomes a shared fact

With interop, institution A can share relevant messages and transactional data for PvP settlement atomically (efficient, transparent, deterministic).

The horizontal nature is critical. Interop isn’t a payments solution or a treasury product. It’s the underlying messaging fabric that all of these domains need. Together, this forms the foundation for an incorruptible financial infrastructure that institutions can rely on at global scale.

Why ZKsync?

There is an emerging consensus on institutional blockchain design: private execution environments for sensitive operations anchored into a public base layer that provides verifiable integrity. Each institution operates its own chain for internal workflows, while Ethereum serves as the neutral, decentralized coordination layer they all anchor into.

ZKsync Prividium is the concrete implementation of this architecture. A Prividium is a private ZK chain built on ZKsync, anchored directly to Ethereum, and designed to give institutions full privacy for internal activity while relying on Ethereum for shared verification. Once this architecture is adopted, the key question becomes how these private chains coordinate with each other and with Ethereum without introducing new intermediaries or external standards.

This is where ZKsync’s native interop model provides a decisive advantage. Because every Prividium is an L2 on Ethereum, each chain can immediately leverage Ethereum’s liquidity, security, and broader ecosystem. Institutions that deploy a single Prividium already receive private execution, trust-minimized settlement on Ethereum, and direct connectivity to all Ethereum-based systems, even before other institutions adopt Prividiums.

As more Prividiums are deployed, an implicit interop network forms. Private chains can validate each other’s messages natively, with low latency, privacy preservation, and deterministic correctness. This avoids the chicken and egg problem that usually prevents interoperability networks from forming. The network emerges naturally from the architecture institutions are already choosing, instead of from attempts to impose a new external standard. ZKsync succeeds because Prividiums make interoperability a built-in feature of institutional blockchain adoption, with Ethereum as the neutral base and ZKsync as the platform that connects private chains to it.

Connecting Back to ZKNomics: Why This Creates Token Utility

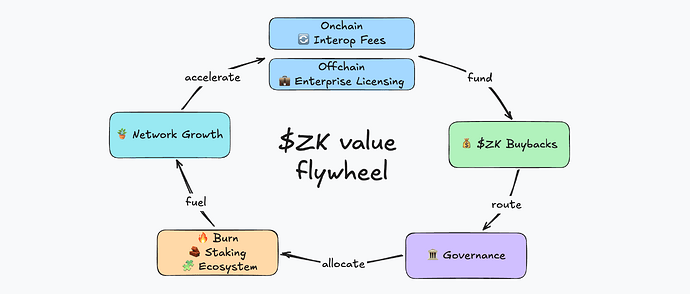

In Part I of the ZK token proposal, we introduced onchain interoperability fees as a potential vector for long-term token utility. With the interop architecture described above, this becomes concrete. Prividiums create a shared cryptographic fabric where institutions coordinate directly across many chains. Every interop message requires verification, and each verification can carry a protocol fee.

To put this in perspective, SWIFT processes more than fifty million messages per day and generates over a billion in annual fees. If private chains become as common as corporate banking infrastructure, which many institutions are now exploring, the number of messages flowing through ZKsync’s Interop could reach very large scales, even with modest adoption. Note: This analysis is illustrative only and does not project or guarantee similar adoption or revenue generation.

Interop creates the coordination surface, and the fee model ties that coordination directly to token utility.

From Chains to Economies

As ZKsync expands its ecosystem of many chains, public and private, Interop transforms them from disconnected systems into a unified economic substrate. Institutions use it to coordinate. Coordination may generate fees that could support ecosystem activities designed to benefit the network.

The significance is not that Interop connects chains. It’s that it connects economies.

This represents the infrastructure opportunity we’re building toward.

Disclaimer: This document presents a proposed design for community governance consideration only. No representations are made regarding potential economic outcomes. Implementation requires community approval through established governance processes. This is not investment advice or a solicitation.