Abstract

ZKsync Ignite (TPP-001) has had a strong, successful launch, increasing DeFi TVL on ZKsync Era by 158% (~$97MM → ~$250MM) and exceeding our TVL goal for S1 within the first month of the program – despite significant market turmoil across crypto markets including $ZK price decreasing by over 50%. The program has created strong foundational DEX and lending markets, reduced slippage for stable-stable $1M USDC-USDC.e trades to ~5.4 basis points and USDC-USDT to ~6.5 basis points (our program-end target is 5 bps), improved our native USDC by 2.5x, and has brought in $22M net inflows. Beyond addressing incentive farming techniques (looping, bots, etc), our directional guidance is for the program to 1) shift focus to further improve price execution (eg reducing slippage) especially for volatile pairs now instead of in S2 as initially planned (vs. continuing to increase TVL), and 2) refine pool + protocol selection to double-down on what’s working.

Highlights

1. DeFi TVL Growth

- Start to Current: TVL grew from $96.6M on January 1 to about $249.6M, exceeding our upper-bound expectation for Season 1 (projected $137M).

- See Appendix 1 for detailed metrics on TVL growth per $1 of incentive.

2. Slippage for Stables

- $1M trades between USDC–USDC.e (currently 5.4 bps) and USDC–USDT (currently 6.5 bps) are approaching the TPP target of 5 bps.

- Pre-Ignite, these pools did not have sufficient liquidity to handle $1M trades without routing through other assets.

3. Bridging Inflows vs. Outflows

- Over $55M in net inflows occurred in the first week of Ignite, with outflows picking up at the end of each period.

- Overall, $21.9M in net inflows remains on ZKSync Era.

- See the bridging dashboard for additional data.

4. ZK Performance

- $ZK has tracked other L2 tokens (ARB/OP) since Ignite’s launch.

- Of claimed tokens, ~40% are sold, ~38% are deployed back into DeFi (vs. ~2% in Arbitrum STIP), and ~11% remain in user wallets.

- $500K (4.6 million ZK) have been sold (21% of earned ZK) since Ignite began, when averaged over the 30 days since claims went live is < 0.2% of daily volume and thus has not meaningfully impacted $ZK price performance.

- See Appendix 2 and the claims dashboard for additional data.

5. Native USDC Transition

- Native USDC assets on-chain increased over 7× (from ~$10M to ~$75M), surpassing bridged USDC TVL.

- See Appendix 3.

6. Jumper

- As the official bridge partner of Ignite, we collaborated with Jumper on a custom marketing program which drove over $70M in inflows (over $20M net inflows in the first week) since the program’s start.

- See bridging dashboard for additional Jumper data

7. Evolving Strategies

- A flexible allocation strategy allows us to adjust quickly from period to period.

- In the initial period, we focused on TVL growth, which far exceeded expectations.

- We then shifted to slippage and v3 DEX pools in the second period to improve price execution.

Lowlights & Key Learnings

1. Looping

- As we expected, looping (borrowing and re-supplying the same asset on lending platforms) surfaced.

- Initially, we maintained simple rules and did not actively discourage “degen” farming, leveraging it for early TVL boosts.

- Looping has persisted, with ~50% of ZeroLend supply and ~40% of Aave supply coming from these strategies.

- Further measures and incentive strategies are planned to curb these activities for the remainder of S1.

2. Liquidity Mining Bots

- When incentive-to-fee ratios were high, bots extracted outsized rewards on v3 pools, hindering organic adoption of efficient liquidity structures.

3. Declining ZK Price

- Since the start of the Ignite program, $ZK price has dropped by ~50%.

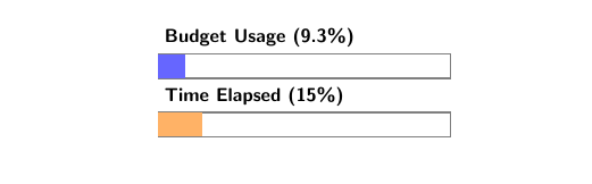

- In response, we increased allocations to maintain target APRs, while maintaining our budgeting goals, having spent < 10% of total ZK allocations (~15% of the way through the nine-month program). This strategy was intentional to preserve capacity for later stages and to accommodate price fluctuations.

Remainder of S1 Plan

1. Primary Focus on Slippage

- USDC–ETH slippage for a $1M trade is currently ~2.4%.

- ZK–ETH slippage for a $1M trade is currently ~4.3%.

- Goal: Reduce each to < 175 basis points (loss of 1.75%) by the end of Season 1 (final TPP goal: 120 basis points).

- For stable-stable pairs, achieve the 5 basis slippage target on $1M trades by the end of Season 1.

2. Increased APRs on ZK

- Improve APR options for $ZK holders to deploy capital in DeFi.

3. Refine Pool Selection

- Reduce the number of target pools to drive higher APRs despite lower token price.

4. Adjust Strategy to Deter Exploits

- Collaborate with protocol teams to refine allocations and curb exploitative behavior.

- Better reward beneficial activity that fosters sustainable growth.

To view the full report with appendices, please refer to this link.