[TPP #] ZKsync Catalyst Program (“Catalyst”)

Hi all, after posting our capital allocation vision for ZK Nation in @drnick’s “Catalyst: Incentivising Network Growth with Token Programs”, this proposal now constitutes a detailed view on the Catalyst TPP.

We started discussions after the inception of the ZK Nation and have been iterating on Catalyst to shape it into a program that we believe will fulfil its high-value ambitions. At the same time, we have structured it in a way to generate significant learnings for the Elastic Chain ecosystem.

We also want to give a quick shoutout to everyone who helped shape this so far - from ZK Chains and Apps to Delegates, ML, and the Association. Thank you!

Over the coming time, we appreciate any feedback - both on and off the forum - and will keep this thread updated at all times. Thank you for taking the time to read through!

During the proposal period, we are keeping the Interest form for ZK Chains and Elastic Apps open. You can find the relevant links below:

Interest form for ZK Chains and Elastic Apps:

AMA Call:

Lastly, we will be holding an AMA for the ZKsync ecosystem to walk through this proposal on Wednesday 22 January at 17.30 CET / 11.30 ET. We will add the link in the Governance Calendar and update this forum post with it.

| Title | ZKsync Catalyst |

|---|---|

| Proposal Type | TPP |

| One Sentence Summary | The ZKsync Catalyst TPP will allocate approximately 165M ZK tokens to reward flagship consumer apps on ZK Chains to grow and maintain activity via KPI-based rewards, VC funding matching, and distribution support. |

| Proposal Authors | Areta & Factory Labs |

| Date Created | 2025-01-16 |

| Version | v1.0 |

| Summary of Action | The Catalyst program will allocate 165 million ZK tokens over 18 months, with 150 million allocated to applications via capped minters, and an additional 14.355 million tokens, managed by capped minters, to cover administrative and unforeseen costs. |

I. Simple Summary

The ZKsync Catalyst TPP (“Catalyst”) is the next step in ZKsync’s growth strategy, building on the foundation of Ignite:

-

Ignite: Liquidity incentives to bootstrap user activity and establish Era as the liquidity hub.

-

Catalyst: Rewards for flagship consumer applications on ZK chains to attract, sustain, and grow their activity.

As described in @drnick’s “Catalyst: Incentivising Network Growth with Token Programs” post, Catalyst’s purpose is to empower ZK Chains to grow through key consumer applications, complementing Ignite’s focus on incentivizing users, while achieving a step-change in onchain metrics and automation of token distribution.

I.e., we transition the focus to the next layer of adoption — the application layer.

By building permissionless mechanisms that economically support app growth, we aim to cement ZKsync as the industry leader in the growth of consumer applications. The operations and legal structure of Catalyst leverage the foundations laid out by Ignite, ensuring operational continuity and compliance.

A reflection period is included to ensure that application eligibility and metric selection remain aligned with the long-term strategic vision of ZKsync, maintaining adaptability and relevance.

II. Abstract

To ensure readability for all audiences, the abstract is easy to digest and includes all necessary information. For those interested in more details, the sections below provide granular information, including design and smart contract considerations.

Factory Labs and Areta have been collaborating to design a comprehensive economic program that aims to position ZKsync at the forefront of the consumer layer. It realises the vision described in @drnick’s “Catalyst: Incentivising Network Growth with Token Programs” post. Our approach to this is called Catalyst.

What It Is

- Catalyst is a Token Program Proposal (TPP) to reward and grow consumer-facing apps on ZKsync-powered chains. It aligns rewards directly with onchain performance, ensuring that only apps delivering real engagement and adoption unlock tokens. Additionally, it supports app builders with distribution support and has a VC funding matching function.

Catalyst Aims To

-

Support Elastic Apps with Capital and Distribution

-

Support ZK Chains by Strengthening their Business Development Muscle

-

Accelerate the Adoption of Unique ZKsync Features, such as ZKsync SSO, Interoperability, and Privacy

Mission

-

The Catalyst Program will allocate ZK tokens and set up key distribution channels to reward and support flagship apps on ZK Chains.

-

Tokens will be distributed in two waves of 20M and 60M, with 20M ZK reserved for follow-on funding for the best performing apps. Each wave incorporates quality checks and halting mechanisms to enable a phased rollout and limit the risk of spending with low value creation.

-

50M ZK will be reserved to match funding with the top 10-20 consumer crypto VCs that invest in apps which agree to deploy on and be exclusive to Elastic Chains for a 2-year period. The capped minter’s funds will only be spent if VCs bring applications that build exclusively on ZK Chains to the ecosystem; otherwise, it will act as a “free experiment” for the community and boost awareness of the ecosystem.

-

The program complements Ignite’s focus on user incentives by shifting the focus to the application layer. It is the natural next step in ZKsync’s growth strategy to overcome the “cold start problem”.

-

Our ultimate goal is to find and nurture the best new consumer apps and help them succeed with capital and distribution. We can ‘pour fuel on the fire’ of top-performing apps — those that demonstrate steady, sustainable success.

Participant Journeys

-

ZK Chains: ZK Chains can apply to be allocated a pool of ZK tokens of 2.5-10M ZK tokens. As ultimate recipients of the tokens, they can nominate multiple apps built on their chain. If nominations of apps are weak, the program will not progress to reward distribution (e.g., might be “too early”). Each ZK Chain application includes the growth strategy per nominated app, the KPIs for each app to achieve, and how the pool of ZK tokens will be allocated across the nominated apps. The Catalyst program acts as an enabler, will steer KPI definition, and retains a veto right if apps do not meet the pre-communicated eligibility criteria.

-

Elastic Apps: Nominated apps can unlock their token allocation over time upon achieving KPIs (e.g., TVL, volume, MAUs), resulting in approximately 1-5M ZK tokens in rewards per app depending on the split proposed by the chains. This ties rewards directly to measurable success. Additionally, apps will receive an upfront unlock upon acceptance, qualify for a follow-on unlock by performing well within the program, and have the chance to get VC funding matching, in case they raise an outside investor round from one of the top 10-20 consumer crypto VCs (TBD) and agree to be exclusive to ZKsync for a 2-year period.

Mechanisms

-

Consumer Focus: Apps targeted direct to users with a focus on providing everyday utility and experiences rather than purely financial services. Example apps include the likes of Farcaster, Friend.Tech, Polymarket, Pump Dot Fun, and Blackbird. This explicitly excludes B2B apps, and includes the likes of gaming apps.

-

Expert SteerCo: Nominations are reviewed by the SteerCo (”CRC”) which includes Matter Labs, Consumer VCs, ecosystem growth experts, security experts, and researchers.

-

KPI Setting: KPIs are set individually for each app in the ZK Chain application and iterated with program operators and the CRC. The program is structured into iterative waves to evaluate KPI and program performance and adjust KPI settings for the highest ROI. KPI Oracles and a ZK Data Commons are the key innovations of the program, enabling real-time performance tracking, dynamic payouts, and permissionless reward mechanisms.

-

Distribution: Marketing support is set up in form of additional discovery channels, aligned with the ZK Chain’s local strategy. Apps participating in the program are automatically considered for inclusion on the canonical ecosystem page, the Catalyst website and awareness campaigns, as well as for the general marketing of ZKsync. Catalyst will collaborate closely with a dedicated marketing partner to develop a unified marketing plan for the program, effectively capturing the attention of a broad audience of users and apps.

Eligibility Criteria & Rewards

-

The program targets established Elastic Apps with operational history, ensuring resources are allocated where they can have the most impact.

-

ZK Chains: Only ZK chains launched on mainnet before April 31, 2025, with a minimum FDV / Valuation of 100 million and a float above 15% are eligible. These are first order eligibility criteria with the CRC able to modify to ensure inclusion of the most desirable apps.

-

Elastic Apps: Apps with a minimum valuation of USD 10 million on eligible ZK chains or more than 5,000 verified users are eligible. Apps using unique offerings such as native account abstraction, interoperability, ZKsync SSO, interoperability, and privacy will be preferred. These are first order eligibility criteria with the CRC able to modify these to ensure inclusion of the most desirable apps.

-

Nominated apps, allocation sizes per apps, and KPIs per app will be proposed by the ZK Chains in their applications. The Catalyst Review Committee will be responsible for determining the final KPIs alongside the ZK Chains and nominated apps and will be utilised to make judgement calls regarding iterations to the allocation sizes, with the end goal of creating a decentralised mechanism that flows tokens out to the ZK Chains based on mechanistic feedback loops and onchain data.

Operations

-

The program will run for 12 months, with an additional 6 months for oversight. A reflection period is included to ensure that application eligibility and metric selection remain aligned with ZKsync’s long-term strategic vision.

-

Similar to Merkl’s role in Ignite, Areta/Factory Labs will not control the tokens; instead, the CRC will oversee token management and decision-making.

-

Public dashboards track app performance and reward distribution, ensuring all stakeholders have access to accurate, real-time data. There is an additional budget for marketing to increase awareness of the program.

-

Marketing of the program and reward pay-outs will prominently feature the message “Powered by ZKsync / Built on ZK Stack.” A dedicated marketing partner will take on key work items to support distribution.

Oversight

-

Catalyst is designed to reduce reliance on centralised oversight, with smart contracts and automated mechanisms enabling trustless operations.

-

The Catalyst Review Committee (CRC), acts as an oversight committee, structured in the same way as in Ignite, with decision-making and program-halting rights, including Gauntlet (Analytics Audit), Polar, Paul Dylan-Ennis (Researcher), Uniswap Builder Support, Aaron Lamphere (Ecosystem Growth), Matter Labs, Ivan Bogatyy (ZK Chain Ecosystem Support), Aleph_v, ZK Nation Security Council (Security), [TBC] (Consumer VC), [TBC] (Consumer VC) and [TBC] (Consumer VC). The CRC is responsible for reviewing the monthly payouts and has veto authority.

-

The committee includes Ivan from Matter Labs who will be a critical lead to help guide and suggest direction and ensure the program has an impact.

-

There are two core service providers: Areta and Factory Labs, to cover program operations and automation.

-

The operations and legal structure of Catalyst leverage the foundations laid out by Ignite.

Size

-

The ZK Catalyst Program requests the right to mint approx. 165M ZK tokens from the Token Assembly’s ZK Token allocation across multiple capped minter contracts. The program spans a 12-month core phase, followed by 6 months of oversight:

-

150,000,000 ZK tokens will be distributed to apps building on ZK chains, paid out upon the achievement of targeted KPIs through KPI and subsidy payments. 20M of the tokens are reserved for follow-on funding for well-performing apps, while 50M tokens are reserved for the parallel Exclusivity VC Matching workstream.

-

14,355,000 ZK tokens will cover fixed development fees, automation fees, and management costs, including operations, oversight, security, and marketing.

-

-

Similar to Merkl’s role in Ignite, Areta and Factory Labs will not control the tokens; instead, the CRC will oversee token management and decision-making.

-

Any unused ZK tokens will not be minted, and the corresponding capped minter contracts will be terminated at the end of the program.

III. Impact

High-quality builders create great apps that attract users, who in turn generate transactions and revenue for the chain.

The TPP has three objectives to fulfil this vision:

I. Support Elastic Apps with Capital and Distribution in a Sustainable Manner.

-

Capital: Allocate ZK tokens to high-potential consumer apps, providing the upfront capital they need to gain momentum and a sustainable path forward—through follow-on rewards for top performers and matching funds that incentivize self-sustaining fundraising.

-

Distribution: Increase app discovery via additional distribution channels aligned with the ZK Chain’s local strategy, e.g., ecosystem placements on the canonical ecosystem page, dedicated awareness sprints and showcasing of top apps.

-

Sustainability: Employ a KPI-based approach that incentivizes ongoing traction, ensuring capital flows only to projects that continue to deliver value.

II. Support ZK Chains by Strengthening their Business Development Muscle.

-

Competitive Incentives: Equip ZK Chains with the token budgets necessary to attract top builders and apps.

-

Coordinated Marketing: Collaborate on local strategies and marketing initiatives so each chain can highlight its flagship apps and unique user experiences, ideally aligned with ZKsync’s unique features. Showcase ZK Chain ecosystem on a public website and work closely with marketing agencies to ensure an effective distribution strategy.

-

Ongoing Support: Provide program operators’ expertise and view across the Elastic Chain ecosystem, guiding ZK Chains in setting up KPIs, growth strategies, and best practices tailored to their local chain strategies.

III. Accelerate the Adoption of Unique ZKsync Features, such as ZKsync SSO, Interoperability, and Privacy.

-

Preferred Allocation: Widely communicate preferred allocation to apps using unique ZKsync features and steer allocation accordingly. After Wave 1, showcase adoption cases to guide widespread adoption.

-

Cross-Chain Synergies: Encourage interoperability between ZK Chains to foster network-wide user flows, amplifying the utility of each individual chain. After Wave 1, showcase interoperability cases to guide widespread adoption.

-

Consumer Vertical: We are in alignment that the core ZKsync features (SSO, account abstraction, etc.) lend themselves particularly well to creating user friendly and intuitive consumer apps and are therefore fine tuning reward systems that are bespoke to ZKsync and will help these types of apps succeed.

Current Focus Verticals and KPIs

Target KPIs

To drive activity of consumer flagship apps, Catalyst prioritizes the following selected Network KPIs in this first phase that are measured across all apps where relevant:

-

MAU

-

TVL

-

Trading Volume

-

TX Volume

-

Fees Generated

-

Interop Activity

Note: Because each nominated app is unique, every app will have its own app-specific KPIs. We want to understand how these individual KPIs affect Network KPIs, so we will measure them in the same way. This will help us collect useful data for the ecosystem and improve our KPI-based rewards system. For example, by seeing how “App Interactions” or “Onboarded Users” in a social media app affect the network-wide KPI “MAU” (Monthly Active Users), we can better adjust our KPI-reward methods over time.

KPI Assessment

All of these KPIs will be assessed over a 12-month period. Further detail on the selected KPIs can be found in the section “Key Performance Indicators (KPIs)” below.

As TPPs and the ZKsync ecosystem mature, the KPIs will become more specific. These more targeted KPIs will require both broader learnings from the system’s first iteration and more advanced smart contract functionality, which will be implemented as the ecosystem grows.

Intake Periods

The TPP will contain a second app intake period after the bootstrapping phase. This is to take learnings from the first intake period, iterate, and improve, while ensuring that the fund allocation is not entirely front-loaded. The decision on a second intake period will be made by the CRC, composed of 5 ZKsync stakeholders, following a review of the first intake of the bootstrapping phase.

ZK Nation Alignment

Catalyst Complementarity

The ZK Catalyst Program has been designed to be complementary to TPP 001, the ZKsync Ignite Program. While Ignite focuses on incentivizing DeFi protocols that are live on ZKsync Era mainnet and have a min. TVL of $1M, the ZK Catalyst Program primarily focuses on growing the ZK Chain ecosystems and support their flagship apps across verticals. This parallel focus covers two key pillars of a holistic growth strategy for the ZKsync ecosystem.

ZKsync Token Program Priorities

Catalyst aligns with the ZKsync TPP Priorities 2025 by accelerating a network of ZK Chains, removing recruitment barriers, and rewarding early pioneers for their contributions. Simultaneously, it invests in next-generation Elastic Apps—particularly those leveraging native account abstraction, privacy, and interoperability—to drive rapid adoption of ZKsync’s unique features. This dual focus fosters a vibrant, interlinked ecosystem and fulfils the TPP’s vision of a thriving, user-centric network.

IV. Mechanic

Now we move on to the more detailed section. Because this section is intended to stand on its own, it repeats some of the points covered in the “easy-to-digest” part, but with added granularity on the underlying dynamics — especially around design and smart contract considerations.

1. Mechanism Design and Transaction Flow

A. Design Principles

The system is designed in the paradigm of “progressive automation”. By creating an automated allocation system for KPI performance, the system will bring about the automated vision of a TPP framework that will support the growth of ZKsync and its wider Elastic Chain ecosystem.

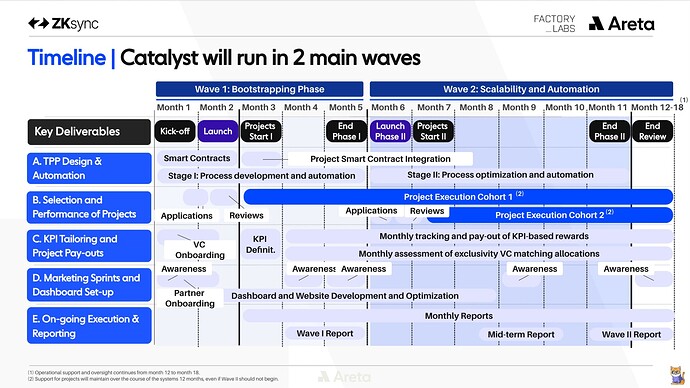

The system will run in two overarching waves.

-

Wave 1: Focused on MVP roll-out to prove program dynamics and build up automation. [Month 1-5]

-

Wave 2: Focused on scaling and implementing decentralisation and automation. [Month 6-12]

-

Moreover, a parallel “Exclusivity VC Matching” workstream will be launched to match funding with the top 10-20 consumer crypto VCs that bring apps to Catalyst that (1) they have invested in, and (2) have agreed to deploy on and be exclusive to ZK Chains for a 2-year period.

Similarly, we have outlined the future vision for the program to be tackled in its next iteration:

- Future Vision: Scaling up / Testing the boundaries of what is possible regarding automation, to start after the initial 12 months of the program. Please note that this is out of scope of this program and is intended to paint a picture of the evolution of the program.

B. Set-Up and Transaction Flow

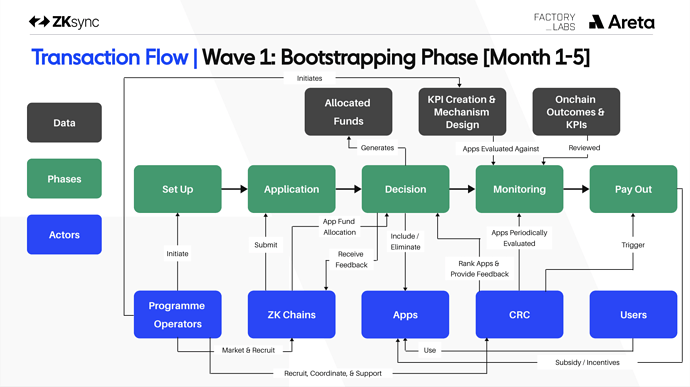

Wave 1: Bootstrapping Phase [Month 1-5]

Wave 1 allocates 20M ZK tokens towards ZK Chains and their nominated apps.

In Wave 1, Areta and Factory Labs develop the following:

-

ZK Chains and App Onboarding: ZK Chains apply to be allocated a pool of ZK tokens of 2.5-10M. They can nominate multiple consumer apps built on their chain to receive these tokens as rewards, and, in their application, must include the growth strategy per nominated app, the KPIs for each app to achieve, and how the pool of ZK tokens will be allocated across the nominated apps. The initial set of ZK Chains are onboarded to the program and the CRC assigns the ZK Chain a number of slots and an allocation size for each slot.

-

KPI Definition: The program operators work with each app assigned a slot to analyse their contracts and onchain data flows to build out a first wave of proposed KPIs, building out an effective mechanism design for incentivising growth in their app.

-

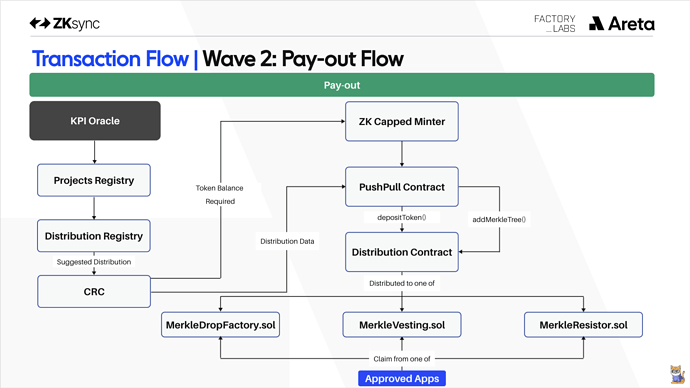

Mechanized Pay Out Flows & KPI Checkpoints: KPI Checkpoints are introduced to streamline payout flows, automatically minting and distributing funds as apps reach predefined KPI thresholds. This is dependent on oracle automation infrastructure integrations. KPI progress is evaluated and the CRC utilises the ZKCappedMinterFactory to distribute capped minters to apps and programme operators support them in their use.

-

Smart Contracts for Asset Flow: A set of smart contracts is deployed to manage interactions with capped minters. These contracts govern asset distribution to apps, with funds flowing based on each app’s progression and performance within the program. This initial contract framework lays the foundation for trust-minimized, performance-based payouts in future waves.

-

Distribution: We set up Elastic App discovery through ZK Chain nominations and strategy submissions. We will build additional distribution channels for top apps, aligned with the ZK Chain’s local strategy. Apps participating in the program are automatically considered for inclusion on the canonical ecosystem page, as well as for the general marketing of ZKsync. We will also collaborate closely with a dedicated marketing partner to develop a unified marketing plan for the program.

Wave 1 Details

I. Eligibility Criteria

-

A key function of the CRC is to work alongside the ZK Chains to determine the allocation of funds and their distribution out to the ZK chains and their flagship apps.

-

Nominated apps, allocation sizes per apps, and KPIs per app will be proposed by the ZK Chains in their applications. The Catalyst Review Committee will be responsible for determining the final KPIs alongside the ZK Chains and nominated apps and will be utilised to make judgement calls regarding iterations to the allocation sizes, with the end goal of creating a decentralised mechanism that flows tokens out to the ZK Chains based on mechanistic feedback loops and onchain data.

-

Wave 1 will allocate up to 25% of the total ZK token allocation of 80M. Wave 1 will allocate funding towards the highest-potential nominated apps as decided by the CRC in conjunction with the ZK Chains, and any additional apps will form part of Wave 2.

-

Each ZK chain is subject to the below eligibility criteria (subject to change):

-

Mainnet Launch: Launched on mainnet before 31 April 2025 with a min FDV / Valuation of 100M and min. float of 15%.

-

These are first order eligibility criteria with the CRC able to modify to ensure inclusion of the most desirable apps.

-

-

Each app is subject to the below eligibility criteria (subject to change):

-

Maturity Criteria (min. one of the below two criteria)

-

Valuation: Min app valuation of 10M on eligible ZK Chains or top 50 token by TVL on a top 20 chain for 6 of the last 12 months; or

-

User Base: At least 5,000 verified user sign-ups over the past three months, or evidence of an active and engaged community as measured by a manual assessment of social activity (e.g., Discord, X).

-

These are first order eligibility criteria with the CRC able to modify to ensure inclusion of the most desirable apps.

-

-

Program Threshold Requirements

- Operational History: 6 months of operational history at time of reward request.

II. Application Phase (2 weeks)

-

ZK Chains apply to the program during a defined application window and will nominate multiple consumer apps built on their chain in their application. Each ZK Chain must include the growth strategy per nominated app, the KPIs for each app to achieve, and how the pool of ZK tokens will be allocated across the nominated apps.

-

Apps nominated by ZK Chains will submit detailed information, which will include questions around the following (not exhaustive):

-

Description of current operations and technology stack;

-

Historical and current user base statistics;

-

Token economics model;

-

Detailed plan to build on ZK Chain;

-

How the funds will be utilized;

-

How the KPIs will be met;

-

Team background and experience; and

-

Long-term vision and roadmap.

-

III. Decision Phase (4 weeks)

-

After nomination by the ZK Chain, the apps meeting the baseline eligibility criteria (to be assessed by Areta in Wave 1) are forwarded to the CRC. If an app does not meet the eligibility criteria, its application will not be passed on to the CRC for further review. In the early stages of the program, the operators, together with the CRC, reserve the right to be flexible in case there is a clear value argument to be made that is not covered in the eligibility criteria.

-

The CRC evaluates the submissions based on an initial evaluation rubric crafted by Areta and Factory Labs. This rubric provides a structured, consistent framework for assessing each app’s alignment with the program’s goals, quality standards, and ecosystem impact.

-

Based on the quality of initial submissions and available funds allocated for the first wave, a threshold for the inclusion of apps is established. Apps that meet or exceed this threshold are approved for the program, while those that fall short receive constructive feedback.

-

KYC/KYB processes will be coordinated for accepted apps.

IV. KPI Definition

Catalyst will focus on the following KPIs:

| Metric | Description |

|---|---|

| Total Value Locked (TVL) | The system defines the target TVL each app should achieve over a 12-month period using benchmarks from other chains and similar projects. |

| Trading Volume | The system defines the target trading volume each app should achieve over a 12-month period using benchmarks from other chains and similar projects. |

| Transaction Volume | The system defines the target transaction volume each app should achieve over a 12-month period using benchmarks from other chains and similar projects. |

| Monthly Active Users (MAU) | The system defines the target level of MAUs each app should achieve over a 12-month period using benchmarks from other chains and similar projects. |

| Fees Generated | The system defines the target fees each app should generate over a 12-month period using benchmarks from other chains, similar projects, and an understanding of the project’s business model. |

| Interoperability Activity | The system defines the target volume of token transfers and other transactions between ZK Chains that each app should achieve over a 12-month period using benchmarks from other chains and similar projects. |

-

The ZK Chains will define KPIs per nominated app with the CRC and program operators to guide the final definition. Factory Labs and Areta then identify the optimal data sources for the KPIs.

-

Factory Labs and Areta will define a first iteration of the technical flows for these KPIs that will form the basis of a KPI Oracle in future waves.

-

Each metric will only be judged in ETH terms and not USD value to avoid for fluctuations.

V. Deployment

-

The tracking for Wave 1 will only begin after the relevant contracts are deployed onchain.

-

The CRC, alongside Factory Labs and Areta, confirms the optimal data sources and technical flows defined at the KPI Definition stage. Metrics will be regularly audited to ensure accuracy and prevent system misuse.

VI. Monitoring & Analytics (Ongoing)

- Factory Labs will track the onchain metrics per app and select the most appropriate visualizations to track performance. A public dashboard will be created and streamed on a website tailored to the program. Areta will lead the sense-making and communication of outcome data.

VII. Payout Schedule & Execution

-

Payout execution is directly linked to the capped minters. Factory Labs will create a smart contract that facilitates more trustless execution flow for payouts.

-

Evaluations by the CRC drive these initial payouts, ensuring they are accurately aligned with app performance while minimizing manual intervention.

-

The token minting and distribution is structured along the key topics below:

- KPI Performance: Selected apps will receive up to 10M ZK tokens upon KPI achievement (in the case of a large single allocation). This data source will be an input into the smart contract and the calculation of the exact token amount to be disbursed will be automated.

-

Payout Schedule:

-

Once an app is accepted into the program, it will unlock 20% of the ZK tokens corresponding as a reward to deploy in time. Following this, payouts will be conducted once per month, with monthly automated verification and payment triggers based on KPI achievement.

-

The monthly payout amount will be determined by multiplying the percentage of the target KPI achieved that month by the total amount for allocation. This percentage is calculated as the average of the KPI achievement across each day of the month.

-

The payout amount will be priced in ZK tokens (assuming that the cost incurred is in USD) at the monthly payout checkpoint based on the 30-day time-weighted average price before the reimbursement, as published by CoinGecko.

-

Once the payout amount is determined, the CRC has a 7-day period to challenge the payout. If the CRC does not invoke a challenge, the ZK tokens are minted and ready to claim by the app. If the CRC invokes a challenge, the payout is cancelled. For Waves 1 and 2, the system will rely on the CRC as the ultimate arbiter, while we will aim to include a more decentralized arbitration in the future vision (see dedicated section below).

-

-

Example:

-

Assume the total allocation to an app is 10M ZK tokens.

-

Once the app is accepted into the program, it will receive 20% of this immediately. Therefore, upon deployment, the app will receive 2,000,000 ZK tokens.

-

At the end of every month, the system will calculate the percentage of its KPI target that the app has met. Assuming that the app has met a total of 25% of its KPI target at the end of Month 1, the app will be eligible to claim 2,500,000 ZK token provided that the CRC does not invoke a challenge in the 7-day challenge period. This will bring the total tokens collected to 35% of its allocation.

-

Once the app has hit 100% of its KPI target, it will have collected a total of 10,000,000 ZK tokens.

-

VIII. Usage of the ZKCappedMinterFactory

Catalyst aims to be an early adopter of the newly iterated versions of the capped minter primitive, which will utilise a factory contract design to distribute capped minters to sub-structures within the programme. This will begin by assigning capped minters directly to ZK Chains and ultimately to the apps themselves.

Catalyst will support teams in unlocking capped minters as they progress through their KPIs and support apps in distributing tokens out to their users if they choose.

A key outcome of this proposal will be trailblazing automated and permissionless flows that leverage the capped minter framework and move committee structures such as the CRC out to mentoring and veto based actions, with token flows directly triggered by the KPI oracle.

IX. Review & Oversight (Ongoing)

We are committed to transparency, accountability, and continuous improvement:

-

Reporting: Bi-weekly internal reports, monthly updates to ZK Nation, and monthly public reports on the ZKsync forum.

-

Public Dashboard: Operations progress will be displayed on a public dashboard, as will the metrics being tracked for the KPI system.

-

Feedback & Optimization: We will gather feedback from first iteration participants and optimize the process accordingly.

-

Impact Assessment: A comprehensive impact assessment will be conducted at the TPP’s conclusion, analyzing KPI effects.

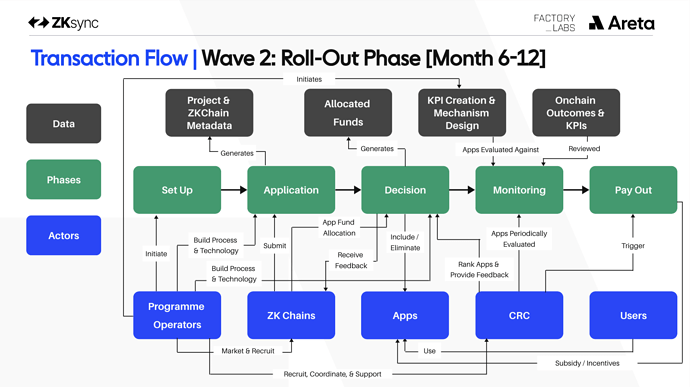

Wave 2: Roll-Out Phase [Month 6-12]

Wave 2 begins once the program reaches technological maturity and a sufficient pipeline of high-quality apps has been established through the application flow. In this phase the program is expanded to include further ZK Chains and more slots are unlocked for performing ZK Chains from Wave 1. Wave 2 allocates 60M ZK tokens towards ZK Chains and their nominated apps.

An iterative design process is used to enhance the KPI framework into a KPI Oracle that is integrated with the ZKCappedMinters to build out permissionless pathways. Apps that choose to distribute tokens out to their end users are facilitated in their distribution by integrating capped minters with a massified token distribution mechanism.

The start of Wave 2 is not dependent on the full allocation of funds in Wave 1 to ensure incentive alignment in the progression of the overall program. This wave introduces enhanced automation mechanisms, further reducing the need for manual oversight while increasing transparency and efficiency.

Wave 2 also introduces the ability for ZK Chains to apply for follow-on funding for apps that are performing well on their KPIs. Each quarter, every approved ZK Chain can request for additional funding through an application form. The CRC will have the final authority making allocation decisions. The minimum threshold is that apps for whom additional funding is being requested are on track to meet their KPIs. The TPP will allocate 20M ZK towards follow-on funding.

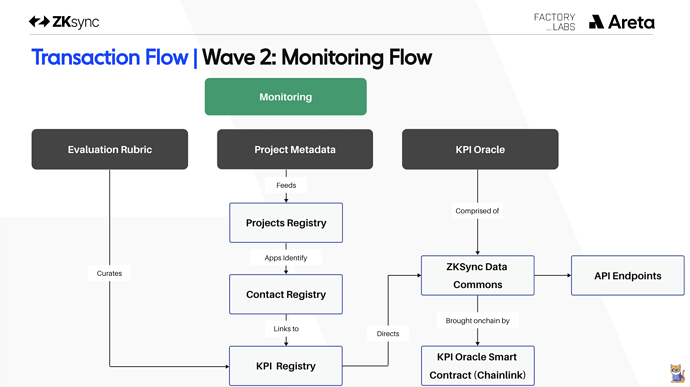

This wave includes the development of the following key technological components:

-

ZK Data Commons & Onchain KPI Tracking: The ZK Data Commons are open API endpoints designed to serve this program and future initiatives that aggregate essential KPI and performance data from apps, creating a centralized resource for monitoring and evaluation. The ZK Data Commons is integrated with an oracle system, enabling KPI data to be brought onchain in real time. This onchain KPI tracking lays the groundwork for increasingly autonomous program operations, providing accurate data that will trigger payouts and track milestones.

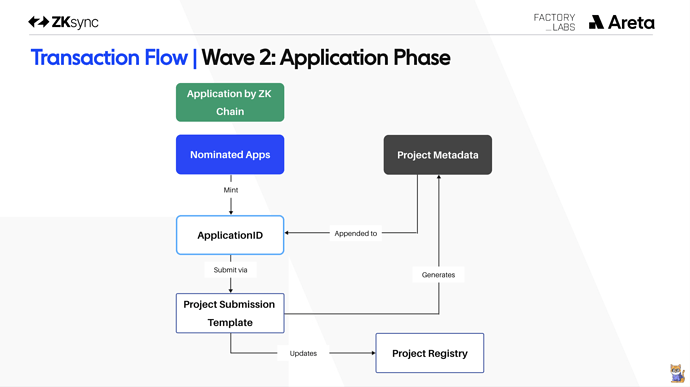

-

Web3-Enabled Application Flow: The application process for Wave 2 will move towards a Web3-enabled application flow, where an ApplicationID will be minted for each app and the relevant metadata will be captured and brought onchain for each app.

From an operational perspective, Wave 2 includes another intake of ZK Chains and their nominated apps.

Wave 2 Details

I. Application Phase (2 weeks)

Akin to Wave 1, ZK Chains will apply to the program during a defined application window and will nominate multiple consumer apps built on their chain in their application. Nominated apps must still meet the defined eligibility criteria and submit detailed information to be considered for inclusion in Catalyst.

Web3-Enabled Application Flow

-

ZK Chains apply to the program during a defined application window and will submit via a Web3-enabled application flow, which will mint an ApplicationID to each nominated app.

-

Apps will complete a Submission Template crafted to collect the relevant metadata required for future evaluation and automation requirements. This metadata will be brought onchain and appended via attestations.

The CRC, Areta, and Factory Labs will likely make updates to the eligibility criteria in Wave 2 based on learnings from Wave 1.

II. Decision Phase (4 weeks)

The Decision Phase for Wave 2 will have one major difference from that in Wave 1. Other than this, it will follow the same process as that in Wave 1.

Automated Verification of Eligibility Criteria

Where it is possible to do so, the system will verify onchain aspects of the eligibility criteria (e.g., TVL of an app) in an automated manner and communicate the output to the CRC. This will streamline the initial review process by removing Areta and Factory Labs from it.

III. KPI Definition

-

The KPI definition for Wave 2 will be similar to that in Wave 1; the CRC, Areta, and Factory Labs will likely make updates to the KPIs based on learnings from Wave 1.

-

As explained above, Wave 2 will include the integration of a ZK Data Commons, which will enable onchain KPI tracking that will trigger payouts and track milestones.

-

The ZK Data Commons will be integrated with the Intelligent Agent to provide apps ongoing insights into their performance relative to their KPIs.

IV. Deployment

The tracking for Wave 2 will only begin after the relevant contracts are deployed onchain.

V. Monitoring & Analytics (Ongoing)

- As in Wave 1, Factory Labs will track the onchain metrics per app and select the most appropriate visualizations to track performance. A public dashboard will be created and streamed on a website tailored to the program. Areta will lead the sense-making and communication of outcome data.

VI. Payout Schedule & Execution

The Payout Schedule & Execution will follow the same process as that in Wave 1.

VII. Review & Oversight

This process will follow the same one as in Wave 1.

Parallel Workstream: Exclusivity VC Matching [Months 1-12]

The Exclusivity VC Matching workstream reserves 50M ZK tokens to match funding with the top 10-20 consumer crypto VCs that invest in apps which agree to deploy on and be exclusive to Elastic Chains for a 2-year period.

This is a risk-free allocation since the capped minter’s funds will only be spent if VCs bring applications that build exclusively on ZK Chains to the ecosystem. If they do not, it will act as a “free experiment” for the community and at least boost awareness of the ecosystem.

The preliminary list of VCs can be found here. We are currently in the process of reaching out and confirming the details of the program with them.

Disclaimer: Participation from VCs is an essential element of this initiative. Should the currently expected interest not materialise sufficiently, the program operators may adapt this component or explore alternative ways to engage VCs with the Elastic Chain or, if still unfeasible, may scale it back.

Workstream Details

I. Alignment & Onboarding of VCs (4 weeks)

The first part of this workstream will involve aligning on the details of the workstream with the VCs, including:

-

Assessing VCs interested in participating;

-

Identifying the nature of the exclusivity agreements (i.e., contractual, incentive-based where funding is staggered over the course of the 2 years, etc.);

-

Identifying the appropriate funding mechanisms for apps (percentage paid upfront, inclusion in the KPI-based program, etc.).

Once these details are decided upon, the VCs will be formally onboarded into the program.

II. Identification of Eligible Projects (Ongoing)

-

Once a VC invests in an app and it signs an exclusivity agreement, the app becomes eligible for inclusion in Catalyst.

-

The identified representative from the VC in question will reach out to Areta and/or Factory Labs to discuss the onboarding of the app into Catalyst.

III. Project Onboarding & KPI Definition (Upon Identification)

Once it is agreed upon that the app in question is eligible to join the Catalyst program, the following details are agreed upon in conjunction with the CRC, the VC, the ZK Chain, and the app:

-

Size of the exclusivity matching given the budget at hand and the value of the investment;

-

KPI Definition, including the appropriate KPIs to track and the optimal data sources for the KPIs; the KPI Definition will depend on when the app is onboarded into the program (i.e., during Wave 1 or 2);

-

The Payout Schedule (e.g., upfront funding, spreading out of funding over the 2-year period, etc.).

IV. Deployment

The tracking for this workstream will only begin after the relevant contracts are deployed onchain.

V. Monitoring & Analytics (Ongoing)

- As in Waves 1 and 2, Factory Labs will track the onchain metrics per app and select the most appropriate visualizations to track performance. A public dashboard will be created and streamed on a website tailored to the program. Areta will lead the sense-making and communication of outcome data.

VI. Payout Schedule & Execution

This process will follow the same one as in Wave 1.

VII. Review & Oversight

This process will follow the same one as in Wave 1.

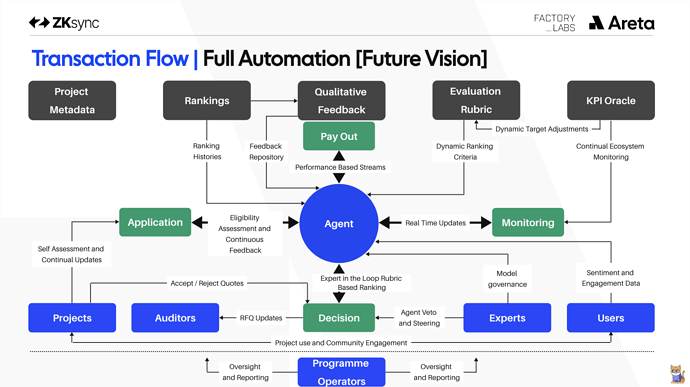

Vision: Full Automation Phase [Future Vision]

Disclaimer: This phase describes the automation vision of the program, is highly dependent on the success of the initial program described in this TPP and would only become effective after another successful TPP has passed through governance.

Building on the design philosophy identified in the cybernetic governance framework approach, Catalyst is designed to be the first iteration of an ongoing TPP that continually supports app growth across the Elastic Chains. Our goal is to present a programme that the Token Assembly wishes to CONTINUE, or ITERATE higher in allocation following successful demonstrable performance in app growth validated by onchain KPIs.

The vision represents the final and most autonomous phase of the Catalyst Program, shifting to an agent-centric design where human involvement is minimal, and most functions are handled by automated systems.

This future vision leverages data from previous iterations to enable a continuous, real-time application and evaluation process, making the program highly adaptive and resilient to ecosystem changes. The ultimate goal is to create a continuous and open system that allows apps to apply, participate, and receive payouts at any time.

The future vision consists of the following key technological components:

Agent-Centric Design and Decision-Making

-

In the future, the agent becomes the central decision-making entity, using data and insights accumulated from Waves 1 and 2 to autonomously assess applications, provide feedback, and make recommendations.

-

The agent now handles most of the initial application processing, ranking apps and assessing eligibility based on a dynamically updated evaluation rubric. This rubric is continuously refined based on evolving ecosystem needs, expert feedback, and user sentiment.

-

Decision Suggestions and Veto: The agent provides decision suggestions, ranking apps based on their performance and alignment with program goals. Experts retain a governance and veto role, allowing them to oversee and steer agent decisions and intervening only when necessary.

Dynamic KPI Tracking and Adaptive Payouts

-

With the KPI Oracle established in Wave 1 and the ZK Data Commons established in Wave 2, we will seek to introduce dynamic KPI tracking, where KPI targets adjust in response to ecosystem conditions and real-time performance.

-

The payout system becomes even more sophisticated, allowing for dynamic payouts that are triggered by performance rather than rigid checkpoints.

Continuous Application Flow and Open Program Access

-

Unlike earlier waves, we will aim to enable a continuous application flow, making the program accessible at any time. Apps can apply when they are ready, and the agent evaluates each application as it arrives, removing the need for fixed application windows.

-

This continuous flow transforms the program into an open, self-sustaining system, where apps of all stages can participate based on readiness and alignment with program objectives. The flexibility of this model also supports diverse types of apps, from early-stage teams to established entities looking to expand within the ZKsync ecosystem.

Enhanced Feedback Loops with Community Input

-

User and community feedback is now integrated directly into the agent’s evaluation process, adding a layer of community-driven governance.

-

Sentiment analysis, user engagement data, and community input are factored into the agent’s assessments, ensuring apps align with the interests and needs of the broader ZKsync community.

Fully Autonomous Monitoring and Onchain Payout Execution

-

Monitoring is now entirely autonomous, with the agent overseeing real-time data feeds from the KPI Oracle and adapting KPIs as needed. The agent also triggers payouts directly through onchain mechanisms, reducing any remaining need for human intervention.

-

The agent compiles and executes onchain payout transactions automatically as apps reach or exceed their targets, using pre-established contract functions to ensure secure and transparent asset distribution.

Governance and Oversight Roles

-

In the future, human roles are focused almost exclusively on governance and oversight. Experts and program operators act as stewards of the program, providing high-level oversight to ensure the agent remains aligned with program goals and the evolving needs of the ecosystem.

-

Human agents retain veto power over agent-generated decisions, stepping in only when anomalies or unforeseen circumstances arise. This governance layer serves as a safeguard, preserving the integrity of the program while keeping day-to-day operations fully automated.

Note: Areta and Factory Labs will ensure the open-source nature of the ZK Catalyst program and its IP benefit the Token Assembly. Should the system prove to be a success, and full automation is achieved after future iterations, a licensing fee will be applied, ensuring the system’s open-source contributions remain accessible and beneficial to both the Token Assembly and the ZKsync Association.

Please note that this future vision is out of the scope of this current TPP and is meant to provide an indication of our vision for the development of the Catalyst Program.

2. Timeline and Key Milestones

Adopting the two-wave approach to ensure a structured roll-out that quickly generates insights and impact while minimizing risk to ZK Nation, Catalyst follows the key milestones below.

-

[Month 1-2] Set-up and Launch of Nomination Process

-

[Month 3] Wave 1: Onboarding of first batch of flagship apps nominated by ZK Chains (20M ZK tokens earmarked for reward pay-outs), and set up of core distribution channels

-

[Month 6] Wave 2: Complete roll-out and automation of the program (80M ZK tokens earmarked, incl. 20M ZK for follow-on funding), and build-out of distribution channels

-

[Month 9] Mid-term report

-

[Months 1-12] Parallel “Exclusivity VC Matching” workstream (50M ZK tokens earmarked)

-

[Month 12] End review and continued oversight until Month 18

The Catalyst Review Committee (CRC) will have halting rights at key milestone points of the program (roughly every 3 months).

For a detailed view on the timeline, see the graphic below. Note that this 12-month core phase is followed by an additional 6 months of oversight.

3. Token Model

-

Token Usage: ZK tokens will be minted and distributed based on the achievement of predefined KPIs, embedded as smart contract parameters, for the apps participating. Tokens will only be minted and streamed retroactively when these parameters have been met.

-

Stream Design: Token streams will be tied to the achievement of onchain verifiable KPIs. Every app that has gone through the eligibility criteria that are a first strong filter will be able to prove its performance and trigger a payment for their performance. These triggers will be automated, with oracles pushing the relevant data per defined parameter to the smart contract in order to trigger the KPI. Find more details on KPIs above.

4. Mechanic Usage Fees

Apps can unlock funds through KPI achievement and, in some cases, will unlock upfront funding. Similarly, smart contract developers and system designers will receive rewards upon the successful setup of the system.

5. Technical Delivery Risk

Catalyst aims to push the boundaries of capital allocation in decentralised ecosystems; however, the technical delivery risk is low. Primarily, the build is technical integration work synthesising highly commodified tooling to transform onchain data into a mechanism that can be integrated into automated payment systems and established governance structures.

Much of the work will take the form of data science and mechanism design, with Factory Labs and Areta collaborating with app teams directly to shape their KPIs and mechanisms to best capture, reward and incentivise network growth. Factory Labs will leverage its existing audited smart contracts for token distribution and the recently released V2CappedMinter framework minimising critical risk on new smart contracts. As extensions to the proposal, Factory Labs will create 1-2 new smart contracts for facilitating trustless execution flows, but the success of the programme is not contingent on these primitives.

Wave 1 will lean heavily on Areta’s operational competencies onboarding and supporting ZK Chains to matchmake the Catalyst programme with their flagship apps and deploying initial non-KPI-linked allocations. This means that the programme can start immediately alongside the initial technical build out work for the KPI Oracles, payment distribution mechanisms and data commons infrastructure, which will be used to progressively automate the distribution process for future waves and subsequent TPPs.

Additionally, Factory Labs will aim to work with other TPPs, such as Ignite and potentially the forthcoming BDB TPP to ensure that work is not duplicated and standardisation and interoperability can be formed across the wider TPP framework.

6. Anti-Gaming Mechanisms

Catalyst’s inherent mechanisms and program dynamics reduce the likelihood of and benefit from gaming the program. In this context, we define gaming as apps farming with fake activity to hit KPIs, i.e., apps abusing the system and trust of ZK Chains. We mitigate this through the following mechanism design:

-

Unlike in anonymous airdrops, app builders are doxxed and apps seeking to use fake activity expose themselves to reputation risk and the possibility of not receiving long-term support from the ZK Chain they are building on (and the wider ZK ecosystem).

-

Everything is public. We will look into the transactions and how KPIs are achieved. If there is suspicious activity, we will publicly highlight it on the website dashboard and inform the DAO / ZK Chains.

-

This will result in (1) funds not being paid out due to the veto right of the review committee, and (2) reputational damage for the app in question in the community and on its home ZK Chain, which the app would, in all likelihood, want to avoid at all costs.

7. Halting Mechanisms

Being mindful of the early stage of TPPs as a concept, we aim to mitigate risks for ZK Nation by avoiding early overcommitment of funds. To achieve this, we propose implementing clear halting mechanisms that allow for the TPP to be paused or cancelled if necessary, split into two parts:

A. Initial Halting Mechanisms

In the beginning, halting mechanisms will be executed manually via committee vote. The initial halting mechanism will operate similarly to the one proposed in the current Ignite proposal.

-

Cancellation / Pause / Reassessment by CRC: The Catalyst Review Committee (CRC) may cancel the Catalyst TPP if the program fails to meet key metrics or app applications are assessed to be low quality and/or don’t reach program requirements. The CRC has the opportunity to cancel the TPP at different timepoints throughout its operation, within a 14-day period following each of these timepoints detailed in this chapter.

-

Responsibility upon Cancellation: If the CRC decides to cancel the TPP, they are responsible for the final distribution of disbursements for work-to-date within seven days of the end of the active season. After all necessary tokens have been minted and distributed, the capped minters will be destroyed to ensure no unallocated minted tokens remain.

-

Pause by CRC: In cases of investigation or uncertainty, the CRC may use the “Pause” method in the CappedMinterV2. This allows the CRC to pause and subsequently restart the program as needed.

-

Reassessment by CRC: If the price of ZK experiences a significant decline (-50% from last 30 day average), the CRC will reassess the program to evaluate its ongoing viability and effectiveness. This reassessment may involve reviewing the program’s objectives, financial sustainability, and overall impact. Based on the findings, the CRC may implement necessary adjustments or take appropriate actions to ensure the program remains aligned with its goals and market conditions.

-

-

Pause / Cancellation by Token Assembly: The Token Assembly may cancel the Catalyst Program by passing a Token Program Proposal (TPP) on the Token Governor to revoke the minter role from all capped minters related to the Catalyst TPP.

-

Responsibility upon Cancellation: If the TPP is cancelled by the Token Assembly, the CRC must make a final distribution of disbursements for work-to-date before the end of the timelock period for the cancellation proposal. Upon execution of the proposal, no further tokens will be distributed via the Catalyst Program.

-

Pause by Token Assembly: In cases of investigation or uncertainty, the CRC may use the “Pause” method in the CappedMinterV2. This allows the CRC to pause and subsequently restart the program as needed.

-

B. TPP Review and Halt Points

- Month 5 - Mid-term Review:

By month 5, apps should be onboarded and 1-2 months into operation, providing early signals of performance on their KPIs.

- Month 9 - KPI Performance Review:

By month 9, apps will have been operational for 3-4 months, allowing for a thorough KPI performance review of Cohort I. Cohort II should be onboarded.

C. Future Halting Mechanisms

Looking ahead, as discussed in the third ZK Nation community call, the new version of the capped minter will include automated cancellation mechanisms. We plan to assess these early and aim to incorporate them into our broader automation efforts in collaboration with Factory Labs. This integration will enhance the efficiency and responsiveness of the halting mechanisms as the system evolves.

D. Return of Funds

If there are any unused but available tokens left to be earmarked at the end of the TPP, the minting rights on the capped minters will be revoked.

If there are any unused but available tokens due to apps failing to meet their KPIs 12-18 months after the point at which the apps have deployed, the minting rights on the capped minters will be revoked.

V. Contributors and Resource Allocation

1. System Design, Strategy, and Management: Areta

Areta is a leading governance strategy firm focused on ecosystem growth. Their core focus is to increase the number of high-quality builders in decentralized ecosystems. In this regard, they develop solutions to activate capital strategically. Areta’s connected investment bank with deep strategic expertise enables us them to serve their partners holistically, rather than working in isolated governance silos. Areta has had the privilege to work alongside industry leaders such as Uniswap, Arbitrum, Safe, Aave, and dYdX.

Responsibilities

-

TPP Infrastructure Set-up: Managing the set-up of the TPP and roll-out of automation plan.

-

Project Management: Overseeing the day-to-day operations of the TPP to ensure smooth execution and alignment with objectives.

-

Project Eligibility Criteria Verification (Wave 1): Verifying if project applicants have met the outlined eligibility criteria in Wave 1.

-

KPI Definition: Areta, along with Factory Labs and the CRC, will be responsible for guiding the KPIs to be achieved by each project.

-

Marketing: Identifying and engaging with a marketing agency to develop a unified marketing plan for Catalyst, and leading the definition, communication, and rollout of the marketing effort.

-

VC Engagement: Aligning and onboarding VCs, maintaining constant communication through the program, and leading the definition of the funding matching, KPIs, and payout schedule for accepted projects in the Exclusivity VC Matching workstream.

-

Stakeholder Communication: Leading key interaction points between ZK Nation, ZK Chains, apps, Matter Labs, the CRC, VCs, and any other involved stakeholders.

-

Review, Oversight, and Reporting: Ensure accurate reporting via bi-weekly internal reports, monthly updates, creation of a public dashboard, monthly public updates, feedback gathering and optimization of the system, and conducting a comprehensive impact assessment.

-

Performance Monitoring: Tracking KPIs and project milestones to facilitate timely token distributions and reporting.

-

Legal Framework Support: Supporting alignment via a robust legal framework, including managing KYC/KYB and adherence to terms and agreements for Chains and apps.

-

Smart Contract Development Support: Designing the requirements for the smart contracts per accepted project.

-

Website Development: Owning the roll-out of visual dashboard and website and establishing community interaction points.

Resources

-

Full Areta Project Team: Consisting of two senior resources, incl. co-founder, and two project managers dedicated to the development and management of Catalyst with market-leading profiles in capital allocation, program management, governance, and legal.

-

The budget is divided equally into two parts: an operating allocation, paid in USDC to ensure minimal cost coverage, and a ZK token allocation, paid in ZK tokens to demonstrate the operator’s commitment and vested interest in the success of the ZKsync ecosystem. Paid out monthly with regular halting mechanisms as outlined in this proposal.

-

Total Allocation: 4.3M ZK tokens over 18 months development and operation (12 months core + 6 months oversight). This includes:

-

Retroactive payment for initial program design: 350K ZK tokens

-

2,685 hours of effort covering system design, development, and management

-

830 hours of effort for developing and operating the technical integration

-

660 hours of effort for continuous operations and oversight beyond the core program phase

-

Detailed Deliverables

| Workstream | Deliverables | Timeframe |

|---|---|---|

| I. Strategy and System Design | - Define token program strategy, including goals, KPIs, and key automation/decentralization elements - Develop and launch token program, including committees and capital allocation mechanisms - Onboard partners (CRC, Selection Squad, solution partners) |

Month 0-2 for Set-up; Month 3-11 for Automation and Decentralization Support |

| II. Business Development / Coordination with ZK Chains | - Analyze the ZK Chain ecosystem, including usage data on chains and apps - Onboard ZK Chains and their nominated apps to the program - Set up an initial business development plan for non-ZK Chain-related projects to migrate |

Month 0-12 |

| III. Project Application Management, Onboarding, and KPI Setting | - Manage project application process, including education sprint, community interactions, and applicant support - Lead onboarding of projects, including handover to smart contract integration - Set tailored KPIs per project for CRC review |

Month 1-2 for Wave 1; Month 6-7 for Wave 2 |

| IV. On-going Management (App/Provider Support & Program Optimization) | - Continuously assess program and project performance, including adjustments to optimization elements - Lead program interactions with key stakeholders (ZK Chains, app builders, ZK association, token holders) - Support integration of automation/decentralization mechanisms |

Month 3-18 |

| V. Program Monitoring and Reporting | - Translate program assessments into monthly community updates - Lead community presentations online (e.g., community calls) and offline (e.g., key conferences) - Create mid-term and end-of-program outcome reports |

Month 4-5; Month 11-12; Month 17-18 |

| VI. Marketing | - Identify an appropriate marketing agency to partner with - Define scope and collect commercial quotes - Lead communication and engagement with the marketing agency to develop a marketing plan - Engage with ZK Chains, apps, and other stakeholders |

Month 0-12 |

| VII. VC Engagement | - Identify VCs to partner with as part of the Exclusivity VC Matching workstream - Onboard VCs into the program - Lead communication and engagement with VCs - Onboard VC experts onto CRC |

Month 0-12 |

| VIII. Website Development | - Lead development and rollout of visual dashboard and website | Month 0-2 |

2. Technology Provider and Automation Expert: Factory Labs (Dr. Nick)

Factory Labs is the technology provider for Catalyst. This role is included to lead the development of the technological systems for brokering the application flows in the system and building out automated systems that decentralise the system towards more trustless outcomes.

Responsibilities

-

Automation Programme Design

-

Submission Application System

-

Data Design and Analytics

-

KPI & Bonus Structure Definition

-

Smart Contract Design and Integration

Resources

-

Factory Team: Consisting of 5 person team: Founder, Lead Architect and Mechanism Designer, Co-Founder and Operations Manager, Blockchain Architect, Full Stack Developer, Project Support Operative.

-

The budget is divided equally into two parts: an operating allocation, paid in USDC to ensure minimal cost coverage, and a ZK token allocation, paid in ZK tokens to demonstrate the operator’s commitment and vested interest in the success of the ZKsync ecosystem. Paid out monthly with regular halting mechanisms as outlined in this proposal.

-

ZK Total Allocation: 3.9M over 12 months. This includes:

-

Retroactive payment for initial program design: 500K ZK tokens

-

2,833 hours of effort covering research and development and smart contract engineering.

-

1,000 hours of effort for data science, front end development and dashboard development.

-

333 hours of effort for oversight, management and end to end support.

-

Detailed Deliverables

| Workstream | Deliverables | Timeframe |

|---|---|---|

| I. Data Architecture and KPI Oracle | I.I - Catalyst Data Commons: Develop data pipelines and robust endpoints serving as an open API for KPI Oracles and ecosystem stakeholders. I.II - KPI Progress Tracking: Create a dashboard system providing up-to-date information on KPI performance, progress, and payouts. I.III - Data Governance and Arbitration System: Establish governance processes and flows to facilitate data transfer from onboarding through execution, including arbitration waypoints. |

I.I - Month 3-12 I.II - Month 5-6 I.III - Month 7-12 |

| II. Execution Automation | II.I - Smart Contract Payouts: Build robust contracts for tranche-based subsidy reimbursements and automatic performance payouts. II.II - Dynamic Payout Structures: Implement proportional and linear payout mechanisms to reward ongoing KPI performance, adapting to market conditions. II.III - Oracle-based Payout Execution: Develop automated flows that bring onchain data to trigger periodic autonomous payments. |

II.I - Month 1-3 II.II - Month 3-6 II.III - Month 6-9 |

| III. Mechanism Design and Project Support | III.I - Application Analysis and Custom Mechanism Design: Collaborate with projects to build effective reward flows and tailor KPI designs. III.II - Mechanism Iteration: Iterate mechanisms based on periodic reviews to optimize growth and project utilization. III.III - Project Support: Assist projects in effectively utilizing the mechanisms. |

III.I - Month 0-6 III.II - Month 6-12 III.III - Month 3-12 |

| IV. Support and Maintenance | IV.I - Onboarding Support: Help project teams understand and operate their reward distributions. IV.II - Ongoing Support and Maintenance: Provide continuous support and maintenance for all tools and front ends throughout the program. |

IV.I - Month 3-6 IV.II - Month 3-12 |

3. Catalyst Review Committee (CRC)

The CRC is composed of 8 seasoned industry experts and key stakeholders, including experts from the top 10-20 consumer crypto VCs, who oversee the system’s alignment with the objectives and metrics established by the Token Assembly.

The CRC will commence its full operations at the beginning of Wave 1, aligning with the project application phase, and be in preparatory mode until then. Operating within the confines of foundational guidelines and bound by formal legal agreements, the CRC ensures diligent governance. Beyond selecting the most qualified individuals, our goal is to engage members who will contribute lasting value to the ecosystem. We expect their involvement will extend beyond this initiative adding value to ZK Nation — especially crucial at this early point in time.

Membership

Members of the CRC in Wave 1, to be ratified by the Token Assembly upon proposal approval, are:

-

Polar, Paul Dylan-Ennis — Researcher

-

Gauntlet, Trevor Normandi— Analytics Audit

-

Uniswap Ecosystem Growth, Aaron Lamphere — Ecosystem Growth / Builder Support

-

Matter Labs, Ivan Bogatyy — VP Engineering

-

Aleph_v, ZK Nation Security Council — Security

-

[Confirming] TBD — Consumer Crypto VC Expert

-

[Confirming] TBD — Consumer Crypto VC Expert

-

[Confirming] TBD — Consumer Crypto VC Expert

Responsibilities

-

Application Review: Evaluating eligible project applications from the TPP and exercising veto power as needed to maintain quality standards.

-

Monthly Oversight: Reviewing monthly reports provided by Areta and payout recommendations guided by KPI achievements, exercising veto power if necessary.

-

KPI Definition: Areta, along with Factory Labs and the CRC, will be responsible for defining the KPIs to be achieved by each project.

-

TPP Monitoring Meetings: Conducting monthly meetings to review the TPP’s status, hosted by Areta, and publishing public minutes for the Token Assembly.

-

Seasonal In-Depth Reviews: Performing comprehensive reviews at the review points to ensure the TPP adheres to the metrics set forth in this proposal.

-

TPP Adjustments: Adding or removing projects from the system if deemed necessary based on performance or alignment with objectives.

-

System Termination Authority: Deciding to stop the system early if it is not meeting the guidelines set forth by this proposal or for other reasons at the CRC’s sole discretion.

Resources

-

Regular Payments: Each CRC member will receive a monthly budget of 15K ZK tokens per month for each month of operation, with the Matter Labs party waiving the payment.

-

1.155 million ZK Tokens for CRCs operation: 7 parties over 11 months of operation (1 waiving payment)

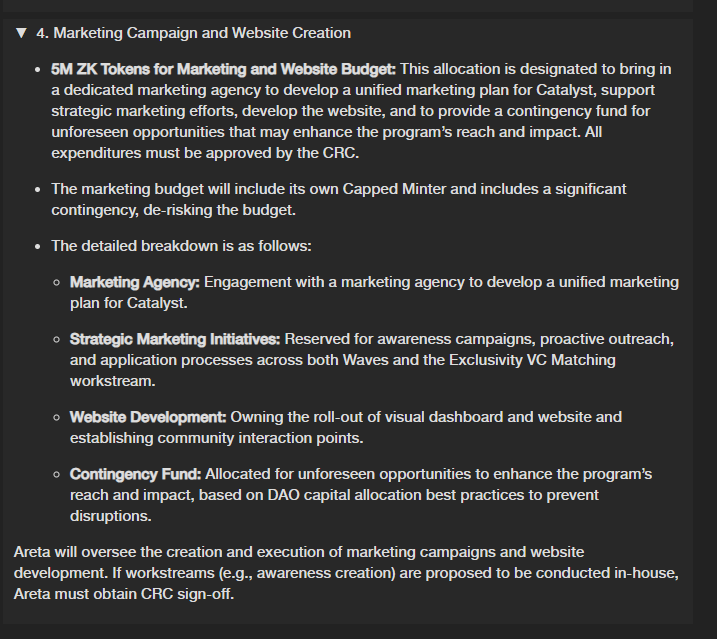

4. Marketing Campaign and Website Creation

-

5M ZK Tokens for Marketing and Website Budget: This allocation is designated to bring in a dedicated marketing agency to develop a unified marketing plan for Catalyst, support strategic marketing efforts, develop the website, and to provide a contingency fund for unforeseen opportunities that may enhance the program’s reach and impact. All expenditures must be approved by the CRC.

-

The marketing budget will include its own Capped Minter and includes a significant contingency, de-risking the budget.

-

The detailed breakdown is as follows:

-

Marketing Agency: Engagement with a marketing agency to develop a unified marketing plan for Catalyst.

-

Strategic Marketing Initiatives: Reserved for awareness campaigns, proactive outreach, and application processes across both Waves and the Exclusivity VC Matching workstream.

-

Website Development: Owning the roll-out of visual dashboard and website and establishing community interaction points.

-

Contingency Fund: Allocated for unforeseen opportunities to enhance the program’s reach and impact, based on DAO capital allocation best practices to prevent disruptions.

-

Areta will oversee the creation and execution of marketing campaigns and website development. If workstreams (e.g., awareness creation) are proposed to be conducted in-house, Areta must obtain CRC sign-off.

VI. Accountability Framework

The Token Program ensures accountability for all involved parties through several mechanisms:

-

Baseline Accountability: Stringent selection criteria, KYB/KYC procedures, and transparent reporting obligations for all stakeholders.

-

KPI-Tied Payouts: Payouts are strictly tied to achieving key KPIs, reducing ZKsync’s risk and aligning incentives.

-

Service Provider Accountability: Service providers are only paid upon achieving key milestones, as outlined in the program.

-

Pricing Accountability: The CRC reserves the right to reassess pricing of the Token Program if there is significant price volatility of the ZK token (e.g., if the price increases or decreases by >50%).

Key participants include: 1) ZK Chains, 2) nominated apps, 3) the CRC, 4) the shortlisted top 10-20 consumer crypto VCs, and 5) the teams developing and operating the system.

Disclaimer: While the TPP offers significant opportunities for ecosystem expansion and security, its success depends on factors such as project quality, market conditions, and the ability to attract new projects.

1. ZK Chains

ZK Chains accepted into the program are subject to a high accountability standard. Next to the eligibility criteria set in place, the program will maintain strict standards for quality and scale and is designed to operate effectively even with fewer chains selected.

2. Flagship Applications

Applications being accepted in the program to receive ZK tokens are subject to high accountability standards:

-

Strict Selection Criteria: Minimum seed valuation of USD 10 million or other relevant metrics showing significant growth as outlined above, with a demonstrated user base and proven operational history.

-

Comprehensive Checks: Selected projects undergo KYC and KYB processes with trusted third-party providers.

-

Incentive Alignment: Awarded tokens follow the minting mechanism, with potential forfeiture of unvested/unminted tokens for unmet commitments.

3. Program Leads

The token mechanism outlined above ensures a gradual release of tokens based on performance and milestone achievement. This aligns Areta’s and Factory Labs’ long-term incentives with the system’s success.

A real-time dashboard displays progress and key metrics. Regular reporting includes weekly internal reports, bi-weekly updates to ZK Nation, and monthly public reports on the ZKsync forum.

Areta

Areta, as the project manager, is subject to multiple layers of accountability.

Operating as a German entity, Areta is bound by stringent regulatory oversight and adheres to all applicable laws and regulations. The team’s transparency is a key feature, with full disclosure of team members and their professional backgrounds. In particular Bernard, Sid, and Dennis, as initiative leaders, are publicly identified, putting their professional reputations at stake.

Areta’s team operates under a comprehensive code of conduct, covering insider trading prevention, confidentiality, and professional behavior standards. To further ensure ethical operations, a whistleblower protection system is in place, featuring an anonymous reporting channel.

With regards to the project management, accountability is achieved through token mechanics and reporting.

Factory Labs

Factory Labs is a UK Limited Company and is bound by UK law and associated regulations. The team produces open source code that will be fully auditable by the wider ecosystem and operates with processes and practices that aim to lead in the industry through radical transparency and ethical professional behaviour.

Factory Labs will share the same approaches to accountability as Areta, with our success tightly bounded to the success of the TPP. Dr Nick Almond will be available throughout to field any questions or to respond to concerns and emerging issues

VII. Proposal Code Specifications

Relevant Multisigs

| Name | Address | Signers |

|---|---|---|

| ZSS_Admin_Multisig | TO BE CREATED | CRC members + 1 member from Areta and Factory Labs each |

| Areta Multisig | TO BE CREATED | Areta team |

| Factory Labs Multisig | TO BE CREATED | Factory Labs team |

| CRC Multisig | TO BE CREATED | CRC members |

| Security Squad Multisig | TO BE CREATED | Security Squad members |

| Marketing Multisig | TO BE CREATED | Areta + Factory Labs team |

Other Relevant Contracts

| Name | Address | Signers |

|---|---|---|

| ZSS_Admin_Multisig | TO BE CREATED | CRC members + 1 member from Areta and Factory Labs each |

| Areta Multisig | TO BE CREATED | Areta team |

| Factory Labs Multisig | TO BE CREATED | Factory Labs team |

| CRC Multisig | TO BE CREATED | CRC members |

| Security Squad Multisig | TO BE CREATED | Security Squad members |

| Marketing Multisig | TO BE CREATED | Areta + Factory Labs team |

VIII. System Operators & Relevant Experience

Areta: System Design, Strategy, and Management

Profile

-

Areta is a leading governance strategy firm focused on ecosystem growth.

-

Our core focus is to increase the number of high-quality builders in decentralized ecosystems. For this, we develop solutions to activate capital strategically and solve the biggest challenge faced by DAOs. Our connected investment bank with deep strategic expertise, enables us to serve our partners holistically, rather than working in isolated governance silos.

-

We have had the privilege to work alongside industry leaders such as Uniswap, Arbitrum, Safe, Aave, and dYdX.

Relevant Experience

-

Areta brings significant experience leading these efforts for established ecosystems. In that capacity, we worked directly with the Uniswap and Safe foundation, both of which extended our mandates after the initial pilots. We are happy to connect you with the relevant counterparties for referrals. These are just a few examples, and we can provide a longer list of case studies and referrals upon request.

-

Uniswap - Uniswap Arbitrum Capital Allocation Program: We developed and led the first cross-ecosystem grant program for Uniswap and Arbitrum. From program design to execution and reporting. Following an onchain vote approval, we led the grant program for the 12 months, and are currently working on an extension that has been asked for by key delegates and the foundation. (Forum Proposal & Temp Check; Snapshot Vote; End of Program Review Report; Onchain vote & Tally for delegates view: 50M/40M quorum, 99.9% vote in favor)

-

SafeDAO - Development of DAO Contributor Efficiency System: In an effort to support SafeDAO’s key contributor initiatives, we developed a contribution efficiency system that enables the DAO to operate seamlessly, enhancing transparency and elevating process standards to an institutional level. (Forum Proposal; Snapshot Vote: 15M/10M SAFE Quorum; 88% vote in favor)

-

ArbitrumDAO - Security Services Subsidy Fund: We designed the Security Services Subsidy Fund (SSSF) pilot alongside Axis Advisory and Daimon Legal, backed by a commitment of up to USD 2.5 million in ARB, which supports security improvements across the Arbitrum ecosystem by subsidizing projects that partner with approved security providers. Reviewed by the ADPC, applications are evaluated through a structured Means Test to ensure impactful use of funds, equitable access, and protection against misuse by larger entities. (Forum Proposal; Adding Security SME; Tally Vote: 146M/112M quorum, 99.53% vote in favour)

-

Uniswap - Uniswap Foundation Subsidy Fund (UFSF): The Uniswap Foundation Security Fund (UFSF) is a $1M initiative created to strengthen security across the Uniswap ecosystem by subsidizing security audit costs for projects building Uniswap v4 hooks. In partnership with Axis Advisory and Daimon Legal, the fund provides access to a customized, proprietary marketplace of vetted security providers, ensuring that projects within the Uniswap Protocol receive tailored support for secure development. (Official Announcement)

-

Find an overview of a selection of relevant case studies here.

Factory Labs: Technology Provider and Automation Expert

Profile

-

Factory Labs is a research and development company that is building at the cutting edge of decentralised governance, token engineering and collective intelligence systems.

-

We are focused on building a suite of tools and infrastructure that will level up DAOs towards greater levels of decentralisation, trustless execution and social consensus.

-