TLDR

$ZK launched as a pure governance token. With interoperability and Prividiums now moving into real-world use, this proposal adds concrete economic utility. The model is straightforward: when the network is used, the ecosystem should benefit. Value would accrue in two ways:

-

Onchain interop fees for moving assets and messages across ZKsync and Prividiums.

-

Offchain enterprise licensing for advanced modules used by banks and institutions.

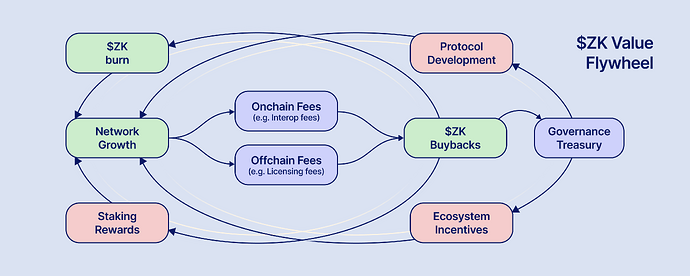

All value would flow into a governance-controlled system that buys ZK and then directs it toward staking rewards, token burn, and ecosystem funding. The goal is to align usage with value, make decentralization economically sustainable, and ensure the network captures a meaningful share of the economic benefits it creates.

Introduction

Over a year ago, the ZK token launched with a single purpose: governance of the ZKsync protocol. That launch also marked the transition of ZKsync from a single chain to the Elastic Network: a network of chains designed to be incorruptible, secured by cryptography and Ethereum finality rather than validator trust. At that stage, it was appropriate to avoid prematurely defining economic token utility. The architecture and adoption path were still forming.

Since then, the network has matured considerably. The Elastic Network today includes almost two dozen chains, interoperability is nearing readiness, and, crucially, Prividium has progressed from concept to real institutional adoption. While earlier deployments established the technical foundation, interoperability and Prividiums represent the most meaningful and economically significant surfaces for value accrual at the protocol level. These systems introduce direct, recurring economic flows, and are being explored by many of world’s largest Financial Institutions. As they soon go into production, it becomes necessary to define clearly how value returns to the network, so that participants and institutions building on this architecture understand the economic model that underpins it.

Earlier this summer, an initial outline was shared for how ZK token utility could evolve. This post expands that thinking and offers a structured path forward for community review and discussion. It is the first in a series of posts intended to initiate the conversation and help the ZK Nation arrive at an updated, collectively shaped ZK tokenomics design.

This document presents a proposed design for community governance consideration only. No representations are made regarding potential economic outcomes. Implementation requires community approval through established governance processes. This is not investment advice or a solicitation.

Foundational Principles

Token-economic systems are complex and nuanced. To guide this discussion, we first propose aligning on a small set of clear principles that frame the design and ensure coherence across all token-utility mechanisms:

1. Make decentralization economically sustainable

ZKsync is one of the leaders in creating the incorruptible financial infrastructure for the world. Such infrastructure cannot depend on a single actor or a narrow set of institutions. True credible neutrality (a core principle we share with Ethereum) requires that the system remains independent, permissionless, and resistant to capture over time.

For decentralization to persist, it must be economically sustainable. The network needs a durable economic model that supports ongoing development, security, and operation by many independent participants, not by a central sponsor. The tokenomics must therefore enable a self-sustaining ecosystem in which decentralization reinforces itself rather than erodes as the system grows.

2. Capture a meaningful share of the value the network creates

Networks create value through compounding effects: as more participants join, the set of possible interactions, counterparties, and markets expands, increasing the usefulness of the system for every actor. For this value to strengthen the system rather than dissipate externally, a meaningful portion must flow back into the network’s economy. This enables continuous improvement, security, public goods funding, and long-term independence. The design goal is to establish a self-reinforcing economic loop where adoption increases network resources, and those resources in turn enhance the network for all participants.

3. Align all incentives around the token

To maintain coherence and neutrality, the token should serve as the unified economic reference point for the ecosystem. Builders, operators, users, and institutions should benefit from the network’s success in a shared and transparent manner. Avoiding parallel incentive structures prevents fragmentation and ensures that all participants are working toward the same long-term outcome: strengthening the network and advancing its mission. Incentives must point in one direction.

Proposed Tokenomics Architecture

Under the proposed design, ZK token utility would be grounded in value created by the network across two economic vectors:

| Category | Source | Description |

|---|---|---|

| Onchain value | Protocol-native fees | Value captured directly through onchain mechanisms at the protocol layer, such as fees for interoperability and other core settlement and messaging functions. |

| Offchain value | Real-world binding mechanisms | Value that cannot be captured natively onchain, but can be routed back to the network through real-world arrangements, such as licensing for enterprise software components. |

All value would flow into a governance-controlled economic mechanism that uses proceeds to:

- Acquire ZK from the market ($ZK buybacks)

- Allocate ZK across:

- Supply reduction ($ZK burn)

- Staking rewards for decentralized operators

- Treasury funding for protocol and ecosystem development

The governance layer would determine allocation parameters, adjusting over time as adoption grows and requirements evolve.

Onchain Value: Interoperability Fees

There are many ways a protocol could capture value onchain, but most introduce friction or distort incentives. Over the past year, we identified one mechanism that is most economically meaningful and aligned with credible neutrality: interoperability fees.

Moving digital assets across system domains today is costly and inefficient. Users either rely on custodial cross-chain bridges with trust and security risks, use capital-intensive third-party bridging solutions, or fall back to traditional financial rails with multi-day settlement and high capital costs.

The upcoming ZKsync native interoperability protocol will enable secure, near-instant movement of assets and messages across public chains and private Prividiums. Removing custodial risk and capital requirements materially lowers costs and increases certainty. In this context, modest protocol fees will not add friction. They will remain significantly lower than existing alternatives while delivering stronger guarantees and faster settlement.

For the sense of scale, interbank messaging already operates at extraordinary volume. SWIFT processes more than 50 million messages per day, amounting to tens of billions annually. If private chains become as common as corporate banking infrastructure, interoperable settlement and messaging will be continuous and foundational. In that setting, protocol-level interoperability fees, whether measured in basis points, cents, or dollars depending on value and use case, represent a straightforward and transparent source of sustainable value for the network. Even a modest share of global coordination activity migrating to cryptographic, Ethereum-anchored systems would establish a meaningful and durable economic base for ZKsync.

Offchain Value: Enterprise Licensing

ZK Stack has been open source from day one and will always remain open source. This is core to the ZKsync ethos. The base protocol, prover, and interoperability layer are public goods available to all, ensuring transparency, verifiability, and credible neutrality. This commitment is essential to building an incorruptible financial infrastructure that can serve as a foundation for the global digital economy.

At the same time, history of the open-source movement shows that developer ecosystems can be weakened when large enterprises adopt community-built infrastructure without contributing back. Certain advanced components, relevant primarily to regulated financial institutions and major enterprises, can enable significant value creation in private environments. Examples include integrations with treasury and ERP systems, compliance and reporting modules, audit interfaces, and operational control tooling. When such capabilities are funded by the ecosystem, it is reasonable that their use by enterprise participants returns value to the ecosystem.

Under this proposal, value generated from such enterprise components would flow into the same governance-controlled mechanism as on-chain value. In practice, this means establishing structures through which licensing-based revenue can return to the network and enter the same ZK buyback and allocation pathways, preserving a single unified economic loop. Achieving this requires careful legal design and compliant organizational structuring to ensure that real-world value flows can be directed back to a decentralized ecosystem in a transparent and enforceable way. That work is already underway.

Large financial institutions routinely pay hundreds of thousands to millions annually for critical infrastructure and compliance systems. There are thousands of banks worldwide, and even partial adoption of ecosystem-aligned enterprise modules would create a meaningful sustainable economic foundation.

Next Steps

This proposal presents a high-level direction for $ZK token utility. It will be shared on X and the ZK Nation forum to collect community feedback. We encourage all ecosystem participants to review, comment, and contribute to the discussion.

Once there is broad support for this direction, we will follow with detailed proposals covering interoperability fee mechanics, enterprise-value routing, governance controls, and reporting structures. The goal is to arrive at a clear, implementable model, adopted through governance and refined as the network scales.

The ZK token began as a tool for governance. Through governance, it can now become the heartbeat of an incorruptible economy. Together, we have the chance to define what a truly self-sustaining, community-owned financial network looks like.