This proposal passed with a majority of 905.63M ZK in-favor of the proposal. See final results here.

| Title | ZKnomics Token Staking |

|---|---|

| Proposal Type | TPP |

| One Sentence Summary | This proposal activates a capped minter with 37.5M ZK (~$1.9M USD) to trial ZK token staking rewards over 6 months with up to 10% reward rate for participation in the pilot. |

| Proposal Author | Dennison / Cliffton (Tally) |

| Proposal Sponsor | Dennison (Tally) |

| Date | 2025-09-01 |

| Version | v1 |

| Summary of Action | Activate a ZK Token staking program in support of ZKnomics vision using Tally’s Staker contract, fund it autonomously over 2 seasons (6 months total) with two capped minters of 10M ZK and 25M ZK respectively. Staking is forward compatible with ZKsync decentralized sequencing. |

| Link to forum post | [TPP-12] ZKnomics Token Staking |

| Link to contracts | GitHub - withtally/staker |

Simple Summary

This proposal activates a capped minter with 37.5M ZK (~$1.9M USD) to pilot ZK token staking rewards over 6 months with up to 10% return for pilot participants. Rewards are distributed autonomously upon the funding of staking contracts. Reward eligibility is limited to tokenholders delegating to active Delegates, those that have voted a minimum of 2 out of last 5 votes.

Motivation

In alignment with the ZKnomics vision published in June 2025, this proposal trials ZK Token Staking infrastructure by deploying Tally’s audited Staker contract system.

As mentioned in the ZKnomics Vision, this staking contract design enables programmatic distribution of rewards, with governance controlling key parameters, including reward amounts and staking rules.

The Staker contract allows ZK token holders to stake their tokens without any predetermined locking period, while simultaneously delegating their voting power. Moreover, delegation persists when stake is withdrawn. Over time, this framework could enable tokenholders to easily engage in any additional token utility opportunities like participating in DeFi with the ZK token.

Participation in this pilot will be limited to a predefined staking cap, with rewards funded by a 37.5M ZK capped minter divided over two seasons lasting ~3 months.

Th proposal trials infrastructure necessary to support staking related to ZKsync’s future decentralized sequencer, while contributing to protocol sustainability via delegation. The system is non-custodial and integrated with Tally’s delegation interfaces.

Key design choices include capped deposits, a reward emission stream over 30-day epochs, and a frontend hosted on Tally (stake.zknation.io).

ZK Token Staking will ensure staking works seamlessly and include recommendations for future versions. Tally and the Program Administrator will evaluate the traction of staking, its impact on voting power, and additional configuration options to align participation to protocol liveness. Additional configuration examples include integration with ZKsync decentralized sequencing, sharing rewards with selected Delegate, contributing to protocol-owned liquidity, and crowdfunding conditional funding markets.

This program ensures security via completed audits, fund distribution pause and cancellation controls, and a framework that allows the Token Assembly to revoke or replace contract administration and operational teams via ZKsync governance proposals. Rewards will be distributed autonomously to eligible ZK token stakers over time.

Impact

ZK Token Staking builds towards a seamless tokenholder experience for the ZKnomincs Vision. Through staking, it deepens alignment between ZK holders and protocol design needs, distributing rewards to those supporting ZKsync’s long-term success. Most importantly, the program trials staking infrastructure necessary for the future decentralized sequencer supporting Stage 1 decentralization for ZKsync.

Pilot Strategic Objectives

- Trial secure and reliable staking infrastructure in preparation for ZKsync’s decentralized sequencer, contributing to the ZKnomincs Vision.

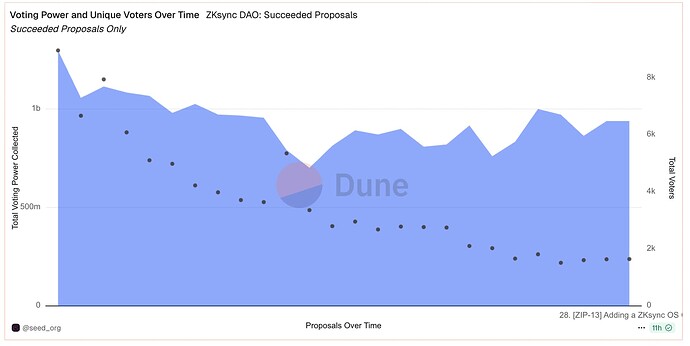

- Increasing active voting power in governance from ~1B to ~2B. Active voting power is currently defined as participating in 2 or more of the most recent 5 votes.

Pilot Operational Goals

- Deployment of staking infrastructure, ready for ZKsync decentralized sequencing and a modular design supporting ZKnomics.

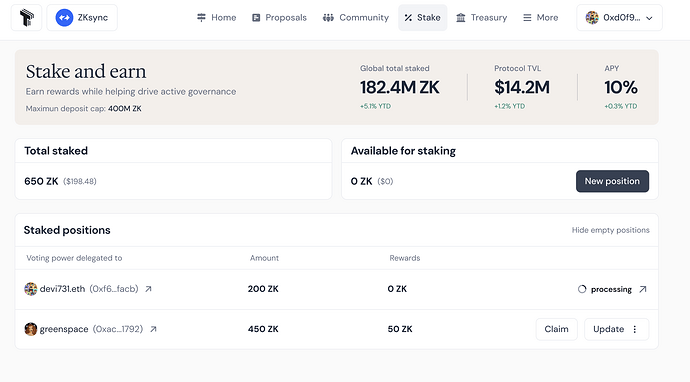

- Season 1 : 400M ZK staked in total, with a maximum of 10M ZK distributed over 3 months (2.5% for 3-months or 10% annualized), 0 incidents.

- Net increase of +200M active voting power (50% of staked ZK)

- Season 2 : 1B ZK staked in total, with a maximum of 25M ZK distributed over 3 months (2.5% for 3-months or 10% annualized), 0 incidents, and integration with decentralized sequencing.

- Net increase of +500M active voting power (50% of staked ZK)

1B ZK is ~15% of circulating supply (~7.1B).

Example Benchmarks Across Ethereum

- ~29% of ETH is staked

- stkAAVE peaked at ~20% of circulating supply

If there is not sufficient impact on the strategic objective during each season, as measured by a the increase in active voting power via staked ZK tokens, then the program may be cancelled by the Program Administrator.

Mechanic

ZK Token Staker Contract by Tally: Pilot Configuration

| Parameter name | Param value | Description |

|---|---|---|

stakeToken |

ZK | Users will stake ZK |

rewardToken |

ZK | Rewards will be denominated in ZK |

REWARD_DURATION |

30 days | Each tranche of rewards is distributed pro-rata continuously over 30d window, to give stakers time to respond to changes in yield. |

admin |

Season 1: Program Administrator Multisig Season 2: ZKsync Governance (Planned) |

The admin can pause minting, set the rewardNotifier , set the EarningPowerCalculator , and change the maxBumpTip. |

RewardNotifier |

MintRewardNotifier | The notifier will call mint() on the ZK token contract, then send the minted tokens to the staking system |

EarningPowerCalculator |

IdentityEarning PowerCalculator | The IdentityEarning PowerCalculator makes every staker eligible.For future staking programs, earning power is calculated based on reward eligibility e.g. active participation in governance. |

maxBumpTip |

0.00005 ETH | The amount of ETH paid to searcher bots who update user’s earning power when it changes. (The IdentityEarning PowerCalculator does not change users’ earning power, but future calculators might) |

Governance compatibility |

Yes | Staked ZK can delegate its voting power. |

Upgradeability |

Yes, via Token Governor | Staking contracts can be upgraded to support decentralized sequencing and other token utility upgrades |

Whenever rewards enter the staking system, they are streamed out continuously over the next 30 days. That prevents discontinuities and race conditions. The turned-off staking system is planned to be deployed a minimum of 14 days prior to initial rewards start. As a result, all token-holders have the opportunity to stake with decreased time constraints.

In the pilot’s season 1, the annualised reward will be a maximum of 10% annualized. This assumes the staking cap of 400M ZK tokens is met, and rewarded a total of 10M ZK over the three-month period. This is equivalent to 2.5% for the 3 months of the season.

In season 2, the maximum reward would be ~10% annualized. This assumes the staking cap of 1B ZK tokens is met, and rewarded a total of 25M ZK over the three-month period. This is equivalent to ~2.5% for the 3 months of the season.

At the contract level, stakers can delegate their staked ZK’s voting power to any address. The Program Administration Team will have the ability to adjust reward eligibility such that staking rewards depend on the Delegate participating in governance.

The staking contracts are, like most smart contracts, open to anyone to call directly from any frontend. Tally will work with staking aggregators, wallets and custodians to integrate the system.

Capped Minter Configuration

Program minters are secured by a program-level rate-limiter:

| Capped Minter | Smart-Contract Admin Role | Smart-Contract Minter Role | Smart-Contract Pauser Role | Minting Start | Minting End | Token Configuration Parameters |

|---|---|---|---|---|---|---|

Zk_StakingPilot_2025 (Parent Capped Minter) |

Token Governor | Zk_StakingPilot_RateLimit_2025 |

ZKsync Security Council | Oct 1, 2025 | Dec 31, 2026 | Cap: 37.5M ZK |

Zk_StakingPilot_RateLimit_2025 (Rate Limit Modifier) |

Program Administrator Multisig | Zk_StakingPilot_Season1_2025 Zk_StakingPilot_Season2_2025 Zk_StakingPilot_Operations_2025 |

n/a | n/a | n/a | Rate Limit: 10M ZK per month |

Zk_StakingPilot_Season1_2025 (Child Capped Minter) |

Program Administrator Multisig | Tally Staker | ZKsync Security Council | Oct 1, 2025 | Dec 31, 2026 | Cap: 10M ZK |

Zk_StakingPilot_Season2_2025 (Child Capped Minter) |

Program Administrator Multisig | Tally Staker | ZKsync Security Council | Oct 1, 2025 | Dec 31, 2026 | Cap: 25M ZK |

Zk_StakingPilot_Operations_2025 (Child Capped Minter) |

Program Administrator Multisig | Child Capped Minters and Rate Limiters for Service Providers. | ZKsync Security Council | Oct 1, 2025 | Dec 31, 2026 | Cap: 2.5M ZK |

- Capped Minters will be subject to an overall rate limit of 10M ZK per month. This rate limit is designed to accommodate variations in spending and potential token volatility.

- Minting rights allow service providers to mint at their discretion within the minting window. All capped minters are subject to the aggregate global rate limit.

ZK Token Staker: Reward Management

Rewards will be incrementally increased by the Program Administrator over the course of each season. This will optimize the reward in such a way that the cap is met at the lowest level of distributed award. For example:

- Season Launch: Set at an initial 3% return.

- Each week: The reward return is increased by an absolute 1% if cap is not met.

- The maximum return is capped at 10%, which is the full deployment of rewards.

- Rewards may also be decreased to fully quantify change in demand.

Reward eligibility is limited to tokenholders delegating to active Delegates, those that have voted a minimum of 2 out of last 5 votes.

Please note the exact initial return and weekly increases will be defined by the Program Administrator during the program based on ongoing analysis. The exact methodology may vary based on guidance to ensure efficient use of pilot rewards.

ZK Token Staker: User Interface

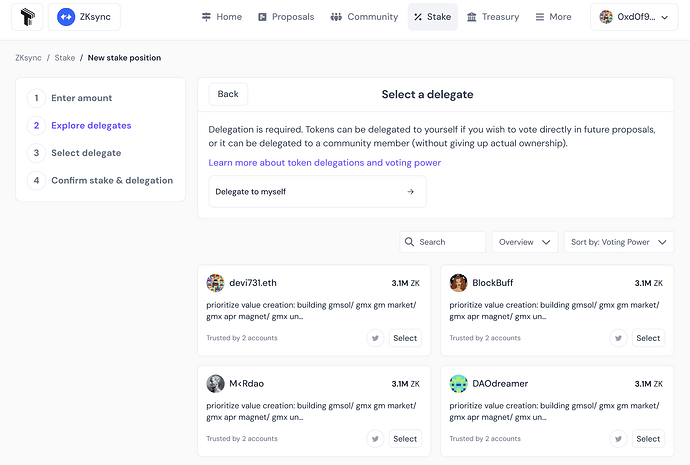

Click to view demo of how the staking page would appear on Tally and on zknation.io. Staking would be available on stake.zknation.io.

- See also Obol’s staking UI on Tally as a reference.

To participate in staking, tokenholders are required to delegate their ZK voting power.

Stakers earn rewards over time. Rewards are proportional to their share of the total staked amount. For example, Alice stakes 600 ZK and Bob stakes 400 ZK, for a total of 1000 staked ZK. No one else stakes. If there is a reward of 10 ZK emitted over one day, 6 of it would go to Alice and 4 of it to Bob. Additionally, stakers can choose to split their voting power to more than one Delegate, and each staking position has its own eligibility to rewards.

Click to View Demo Video

Staking contracts are upgradeable with the Token Governor Timelock set as owner. For future seasons, the ZKsync Token Assembly can choose, via ZKsync Governance, to upgrade the staking contracts include expanded token utility options, such as supporting decentralized sequencing.

Delegate selection is customizable on Tally and guided by the ZKsync Governance Team, in collaboration with the Program Administrator. Delegates eligibility will be refined over time.

Delegate eligibility criteria will also be adapted based on and program performance. Operator selection (e.g. such as sequencers) may become available depending on protocol development progress. Stakers will be able to view their annualized return. For example, 10M ZK rewards over 3 months for 400M staked = ~10% APY annualized.

Operational Timeline Estimate

- September 2025: Governance approval, parameter tuning, UI integration + frontend testing

- October 2025 : Season 1 launch

- January 2026 : Season 2 launch

Accountability

- Token Allocation Tracking: Token minting will be available for public review using the ZKsync Capped Minter Dune Dashboard, or alternative interface if applicable.

- Governance Forum Posts: The Program Administration Team will publish updates on the ZKsync Governance Forum at the start and end of each season. Should a period extend beyond three months, an intermediate update will be included.

- Token Assembly Oversight: The Token Assembly may cancel the parent capped minter at any point via a Token Program Proposal and revoke any further disbursements.

- Security Council Oversight: The Security Council may pause any of the capped minters at any point if deemed necessary.

- KYC/KYB : Required for Program Administration Team and service providers.

- Audit Requirements : Contracts fully audited and published.

- Excess Tokens: Any excess tokens not used for the program should remain unminted. If excess tokens are minted, they will be returned to the control of the Token Assembly.

- Impact: If there is not sufficient impact on the strategic objective during the first season, as measured by increase in active voting power via staked ZK tokens, the Program Administration Team will provide a recommendation to continue or pause the program.

Service Provider Token Allocation

Service provider token allocations are designed to align with program objectives. For ZK Token Staking, token allocations are locked for 6-months, ensuring the Program Administration Team can confirm completion of services prior to unlock.

| Service Provider | Tally |

|---|---|

| Token Allocation | Up to 2.5M ZK tokens, with minting rate limited to ~416,667 ZK per month. |

| Services Description | Staker Smart Contract Deployment: Secure deployment and initialization of the staking contract, customized to meet network-specific requirements. [Supported by ScopeLift Engineering] Frontend Activation & Customization: Integration with the Tally interface, including branding, UI/UX adjustments, Delegate eligibility and discovery, and user onboarding configuration. Analytics & Reporting: Public dashboards and periodic reports to monitor staking activity, program objectives, and participation trends. Continuous Contract Configuration: Ongoing adjustment of staking parameters, reward logic, and utility integrations in accordance with program objectives. Staker Smart Contract Audit: Complete audit of network-specific related customizations to Tally Staker contract. [Supported by Offbeat Security] Continuous Contract Security Review: Ongoing security monitoring of staking contract, and security review of contract changes and additional modules. [Supported by Offbeat Security] Operational Support: Assistance for program execution throughout the program, including troubleshooting, comm |

Service providers will complete a contract with ZKGPS in alignment to the services scope and payment as defined in this proposal.

Program Administrator

The Program Administrator, overseeing Tally’s operational execution and contracts, will be composed by a 3/5 multisig 0x123...456 :

- 1 ZKsync Foundation representative: Marco Cora

- 1 Matter Labs Representative: Steven Correll

- 1 technical partner: Alex Keating, ScopeLift (Confirmed)

- 1 independent delegate: Areta (Confirmed)

- 1 security partner: Assigned Security Council Member

Compensation for independent participants, set at 100,000 ZK for the program (approximately 7-9 months), will be covered by ZKGPS.

The ZKsync Security Council will be granted the Pauser role on program Capped Minters.

Participants

- Tally: Proposal development, staker contracts, frontend, and analytics. Day to day operations.

- Program Administrator: Responsible for overseeing program and admin role of contracts.

- Marketing Support : The ZKsync Foundation will coordinate efforts with current service providers to support the proposal if necessary.

- ZKGPS: Serves as legal counterparty for program service providers.

- Token Assembly: Oversees minting and retains final authority to halt program.